Just one forecaster tasks two consecutive quarters of adverse progress.

Right here’s the WSJ imply forecast in comparison with nowcasts:

Determine 1: GDP (daring black), WSJ October survey imply (tan), GDPNow as of 10/9 (mild blue sq.), NY Fed nowcast as of 10/11 (crimson triangles), St Louis Fed information nowcast as of 10/11 (pink x), Goldman Sachs monitoring as of 10/9 (inexperienced +), FT-Sales space as of 9/14 iterated off of third launch (blue sq.), all in bn.Ch.2017$ SAAR. Ranges calculated by iterating progress fee on ranges of GDP, aside from Survey of Skilled Forecasters. Supply: BEA 2024Q2 third launch, Atlanta Fed, NY Fed, Philadelphia Fed, WSJ October survey, and creator’s calculations.

The WSJ imply forecast is barely much less optimistic than the FT-Sales space imply forecast, and considerably much less optimistic than the nowcasts from Atlanta and NY Feds, and Goldman Sachs. Apparently, the 20% trimmed high/backside bounds are fairly slim, reflecting little disagreement about brief time period progress prospects. The one prediction of two consecutive quarters of adverse progress comes from Andrew Hollenhorst and Veronica Clark of Citigroup -0.9 and -1.5 q/q AR in 2024Q4-2025Q1).

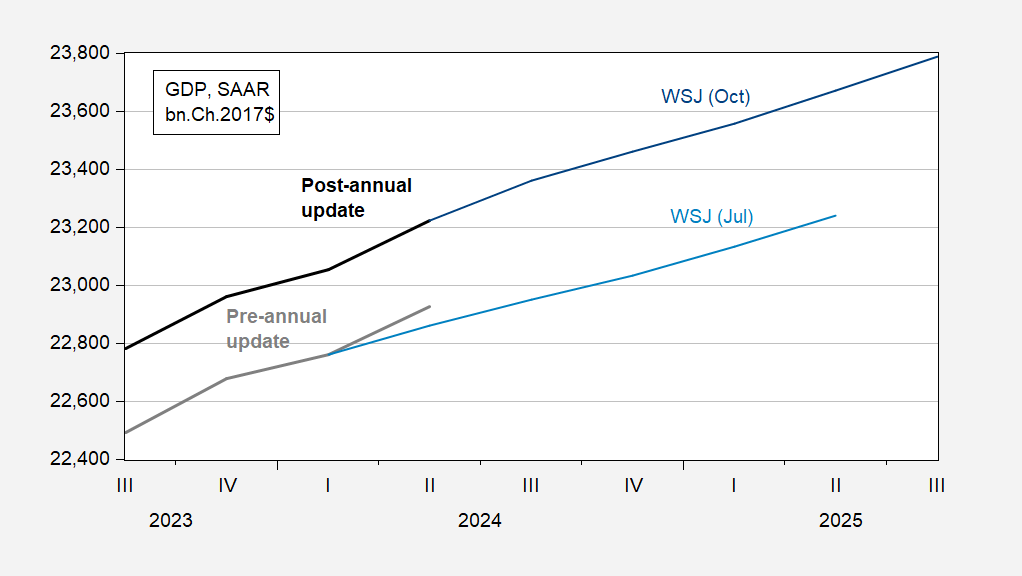

The extent of GDP is forecasted to be a lot greater, largely due to the annual replace has shifted up the contour of GDP, and since the close to time period progress (Q3-This autumn) is elevated by 0.8 and 0.3 ppts respectively.

Determine 2: GDP, post-annual replace (daring black), WSJ October survey imply forecast (blue), GDP, pre-annual replace (daring grey), WSJ July survey imply forecast (mild blue), all in bn.Ch.2017$, SAAR. Ranges calculated by iterating off related GDP stage. Supply: BEA, WSJ, and creator’s calculations.

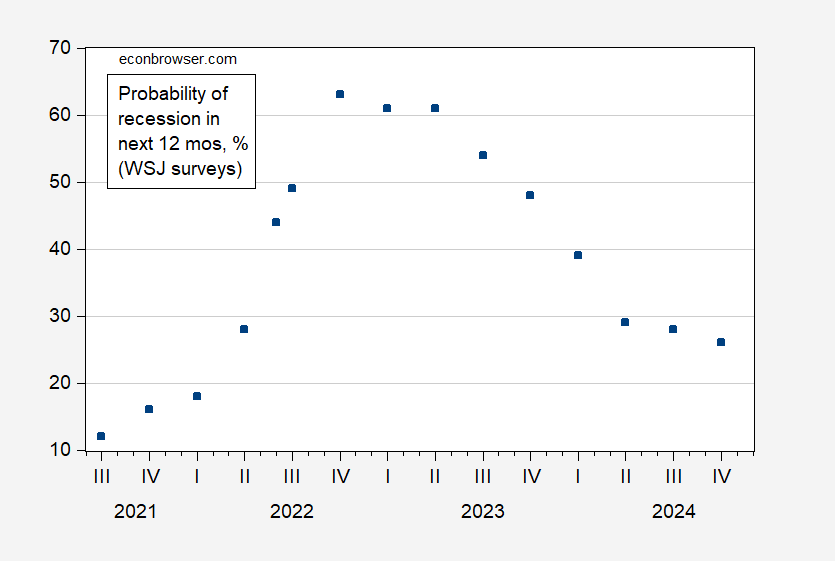

Recession likelihood estimates proceed to say no.

Determine 3: Chance of recession inside the subsequent 12 months , % (blue sq.). Supply: WSJ.

Extra leads to the article.