On the day through which President Biden introduced the repurposing of the positioning that was to be Foxconn’s, I reprint this 2017 evaluation.

From the Legislative Fiscal Bureau, the Memorandum of Understanding between Wisconsin and Foxconn states:

…Foxconn agrees to speculate $10 billion to assemble, over six years, a facility in Wisconsin and create as much as 13,000 jobs, with a reported common wage of $53,875 over a interval of as much as six years. The state’s settlement, below the MOU, amongst different issues, is to offer as much as $3 billion in an financial bundle which would come with refundable tax credit and a building gross sales tax exemption for Foxconn.

What’s the profit price calculation for the state’s taxpayers? To undertake the evaluation, one would want to make a set of assumptions; these embrace:

- The undertaking would require a mean annual employment of roughly 10,200 building employees and tools suppliers incomes a mean whole compensation of roughly $59,600 (together with advantages) per 12 months through the four-year building interval (from 2018 by way of 2021). Whole earnings for these people is estimated at $2.4 billion.

- Practically 6,000 oblique and induced jobs might be created through the building interval, with a mean whole compensation of $48,900.

- Further construction-period jobs would generate elevated state tax revenues (primarily earnings and gross sales taxes) equal to roughly 6.3% of the extra gross wages. The entire elevated state taxes related to the development interval are estimated at $186.9 million.

- Everlasting employees on the Foxconn facility are estimated to extend from about 1,000 within the second half of 2017 to 13,000 starting in calendar 12 months 2021. The common annual wage for these staff is estimated at $53,875… Whole ongoing payroll on the firm is projected to be $13.8 million for the rest of this 12 months and enhance to roughly $700 million yearly starting in 2021.

- All staff are Wisconsin taxpayers (i.e., no Illinois residents).

- State tax revenues related to the extra staff and wages are estimated to extend from about $900,000 this 12 months to $44 million yearly starting in 2021.

- Oblique and induced jobs related to the undertaking are estimated to whole 22,000 starting in 2021, based mostly on a multiplier of two.7. Common annual wages for these people are estimated at roughly $51,000.

- Whole ongoing wages are $1.12 billion yearly, and associated state taxes at $71 million per 12 months. Smaller impacts are estimated in calendar years 2017 by way of 2020.

The conclusion:

[Wisconsin Department of Administration] tasks that the price of the refundable state tax credit below the invoice will exceed the potential elevated tax revenues till the final EITM payroll credit score is paid in fiscal 12 months 2032-33. As of the top of that 12 months, the cumulative web price of the motivation bundle is estimated at $1.04 billion. Starting in 2033-34, funds to the corporate would stop and elevated state tax collections are estimated at $115 million per 12 months. DOA estimates that the undertaking’s break-even level would happen through the 2042-43 fiscal 12 months.

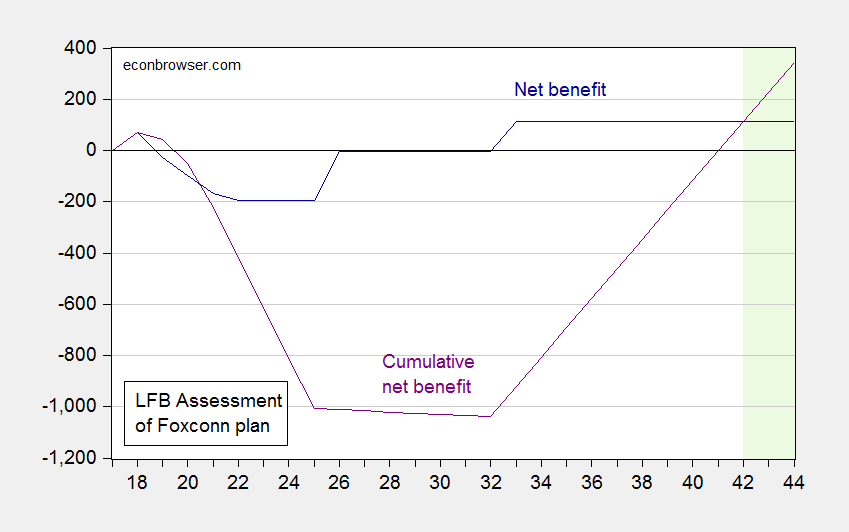

In Figures 1 and a pair of under, I summarize state funds and income will increase, and web advantages stream and cumulation, respectively. The astute will observe that state funds is entrance loaded into the primary 15 years (after which Foxconn may stroll away), and that even below the pretty optimistic assumption of 13,000 further jobs, the break-even happens in FY 2042-43.

Determine 1: State funds (blue) and elevated tax income (pink) below August 2017 Particular Session Meeting Invoice 1, in hundreds of thousands of {dollars}, by fiscal 12 months (2018 signifies FY 2018-19). Supply: Legislative Fiscal Bureau, Desk 4.

Determine 2: Internet advantages calculated as elevated tax income minus state funds below August 2017 Particular Session Meeting Invoice 1 (darkish blue), and cumulative (purple), in hundreds of thousands of {dollars}, by fiscal 12 months (2018 signifies FY 2018-19). Supply: Legislative Fiscal Bureau, Desk 4.

As famous, there’s extensive uncertainty over the rise in employment. LFB blandly observes:

There have been press accounts suggesting that employment on the proposed facility could be nearer to three,000 as an alternative of 13,000 everlasting positions. If this had been the case, utilizing the opposite assumptions outlined above, funds of the EITM payroll tax credit score could be decreased from slightly below $1.5 billion to roughly $345 million over the 15-year lifetime of the EITM zone, however the capital expenditure credit score would nonetheless be estimated at $1.35 billion. The estimated ongoing tax advantages from the undertaking would lower from $115 million to $27 million per 12 months, and the breakeven level could be nicely previous 2044-45.

There’s a critical query of whether or not Foxconn will fulfill its commitments. Hiltzik at LA Instances highlights the 2013 Pennsylvania deal.

Foxconn itself is getting a popularity for making lavish guarantees and letting them lapse, as seems to have been the case with a undertaking the corporate touted for Harrisburg, Pa., in 2013. That deal was for a $30-million plant using 500 employees. However the plant hasn’t materialized.

And from Wisconsin Gazette:

Within the midst of all of the jubilation and hype, it’s essential to do not forget that Foxconn has earned a popularity for failing to fulfill its pledges. The enterprise publication Crain’s warns, “Foxconn Technology Group … has a history of big promises with little to no payoff in the United States.”

Foxconn deserted the commitments it made to Harrisburg, Pennsylvania, the place CEO Terry Gou promised that its small 50-person operation could be expanded into a producing facility with 500 employees. Its announcement generated an “intense buzz” that was “created by a chief executive known to promise projects all over the world that never quite pan out,” The Washington Put up reported.

Guarantees of latest or expanded funding by Foxconn even have been damaged in Brazil, China, India, Indonesia and Vietnam.

“There’s a pattern here,” noticed Alberto Moel, a senior analyst with Bernstein Analysis in Hong Kong.

Bloomberg Information famous that Foxconn’s whole commitments now stand at $27.5 billion, which is greater than Hon Hai has spent up to now 23 years.

The truth that this enterprise doesn’t appear to be an enormous constructive for Wisconsin appears to match the literature that signifies state tax incentives to relocate companies don’t usually have huge payoffs. From a survey by Buss (2001):

Tax literature, nowin a whole lot of publications, gives little steering to coverage makers attempting to fine-tune financial improvement. Taxes ought to matter to states, however researchers can not say how, when, and the place with a lot certainty. Companies might have tax incentives to extend their viability in some places, however researchers can not definitively say which companies or which places.

Maybe extra related to this particular case:

…declining corporations tended to benefit from applications focused towards distressed areas, whereas development corporations tended to find in nondistressed counties. Tax incentives made distressed areas worse or no higher off, whereas nondistressed areas at all times improved

Summary from a roughly contemporaneous evaluation by Noah Williams, previously of UW Madison.

On this paper I consider the potential financial impression of the Foxconn plant on the Wisconsin economic system. I think about components affecting each the direct impression of the Foxconn plant, in addition to the extra broader impacts that it might have. If carried out as deliberate, the direct impression of the plant might be substantial, and the broader impacts may go far past typical fiscal insurance policies. Specifically, the opening of a giant scale excessive tech manufacturing operation by a multinational company has the potential to generate vital spillovers. Drawing on the financial literature on plant openings and international direct funding, I analyze the magnitude of those potential positive aspects. Whereas direct employment multipliers within the literature vary from 1.7 to greater than 3, these most related on this case are within the 2.5-3.0 vary. Thus if Foxconn accounts for 13,000 direct jobs, it might generate a complete of 32,000-39,000 jobs straight and thru its provide chain, suppliers of staff, spillovers on current corporations, and new investments. I additionally evaluation the financial evaluations which have been beforehand carried out, and consider a number of the considerations which have been raised in regards to the proposal. Within the general analysis of the Foxconn bundle, the unsure however doubtlessly massive positive aspects in jobs, wages, output, and incomes have to be weighed in opposition to the sure fiscal prices.