Ryan Cummings and Ernie Tedeschi have a really attention-grabbing article in BriefingBook right this moment which casts new gentle on the disjuncture between measured sentiment and standard macroeconomic indicators. Cummings and Tedeschi doc how the transfer to on-line sampling has altered the traits of the College of Michigan Financial Sentiment collection.

…we consider on-line respondents are ensuing within the degree of the general sentiment and present situations indices being meaningfully decrease, making newer UMich knowledge factors inconsistent with pre-April 2024 knowledge factors. Particularly, we use a easy statistical mannequin to estimate that the impact of the methodological swap from telephone to on-line is at the moment leading to sentiment being 8.9 index factors –or greater than 11 %–decrease than it could be if interviews have been nonetheless collected by way of the telephone.

To display that the swap to on-line surveying has imparted a structural break within the UMich collection, they evaluate in opposition to the Morning Seek the advice of collection.

Supply: Cummings and Tedeschi (2024).

The Morning Seek the advice of survey has been on-line, so it serves as a management. Therefore, the important thing purpose for the shift in measured sentiment.

A cursory take a look at the weighted age distribution of telephone and on-line assignments means that, no, they weren’t random in observe. For instance, on-line respondents have been extra more likely to be older in these transition months, which could have an effect on their sentiment responses. …

A extra formal multilevel logit mannequin–which measures the chance of a person being in a sure age cohort after accounting for different demographic components–confirms this distinction. Respondents 65+ for instance had a 52 % probability of being within the on-line group in April-June, which is greater than twice as possible as respondents 18-24, and this distinction is statistically important …

I don’t know the way the better presence of older respondents interacts with the partisan divide examined in this put up (are Republican/lean Republican voters older than corresponding Democratic/lean Democratic respondents?)

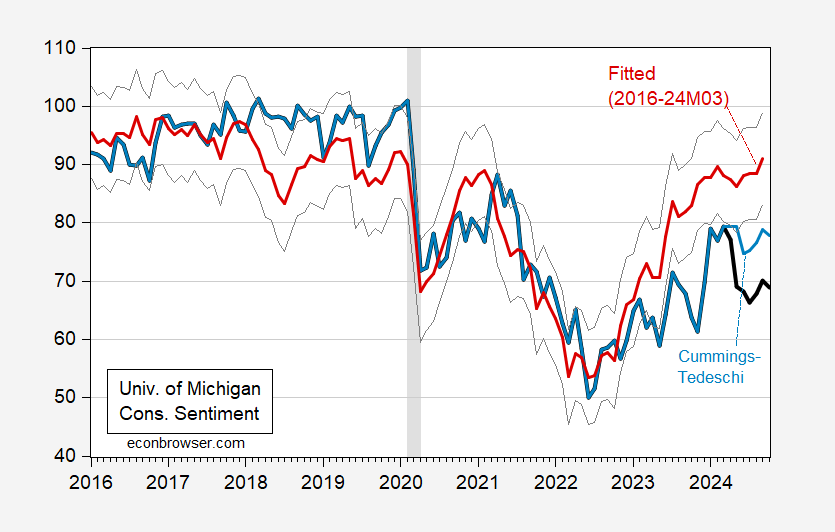

What I can say is that the adjusted Cummings-Tedeschi collection reveals much less proof of a structural break than the official UMichigan collection, when utilizing as regressors unemployment, y/y CPI inflation and the SF Fed information sentiment index.

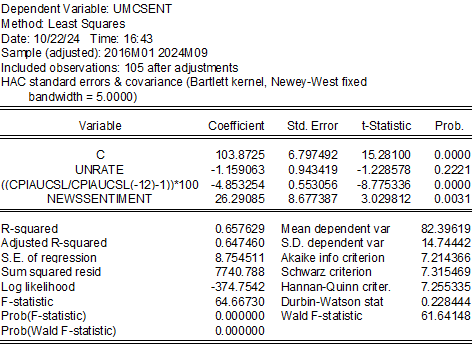

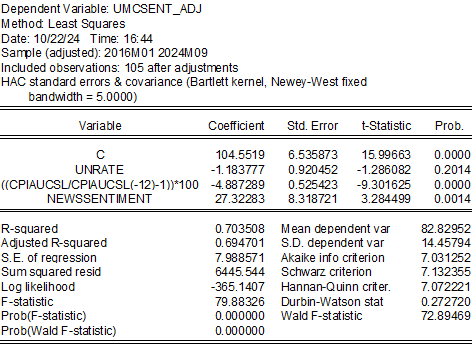

Contemplate these two regressions, first with the official collection, and the second with the Cummings-Tedeschi adjusted collection:

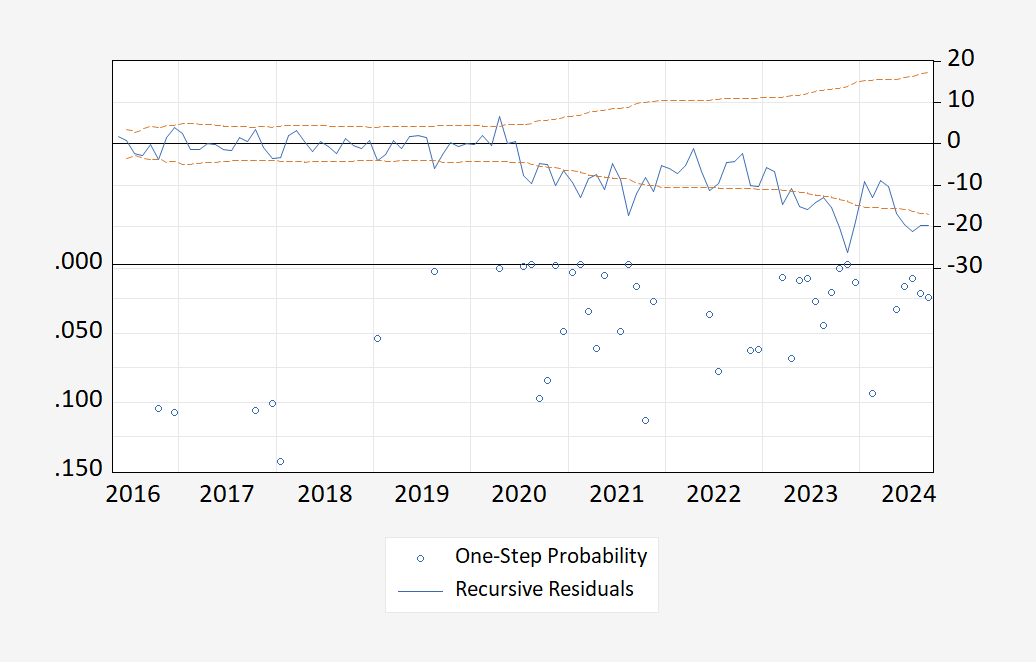

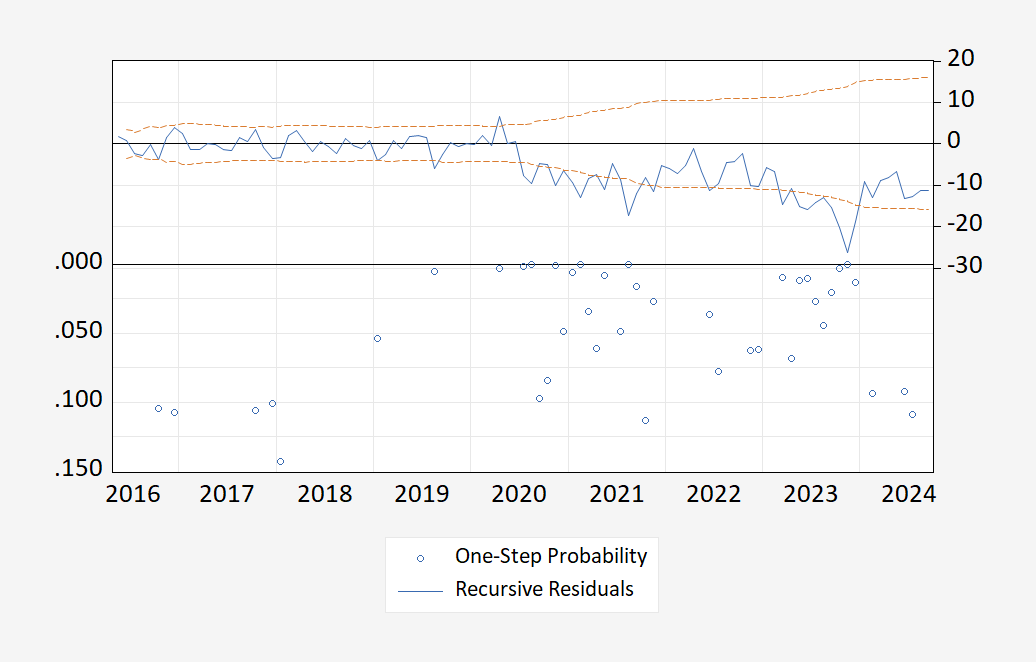

Now think about the respective recursive 1-step forward Chow checks for stability.

Notice that whereas each regressions exhibit instability round 2020 and 2023, the Cummings-Tedeschi adjusted collection reveals no structural break in 2024 across the swap to on-line polling.

That being stated, the swap in survey strategies doesn’t totally clarify totally the hole between observables and sentiment. I estimate the regression over the 2016-2024M03 interval, and predict out of pattern for 2024M04-M10.

Determine 1: College of Michigan Shopper Sentiment (daring black), Cummings-Tedeschi adjusted collection (gentle blue), fitted (pink), +/- one normal error (grey traces). NBER outlined peak-to-trough recession dates shaded grey. Supply: U.Michigan by way of FRED, BriefingBook, NBER and writer’s calculations.

So presumably lower than half of the hole is accounted for by the change in survey strategies.