Article at this time on whether or not it issues if dis-inversion happens as a result of quick charges fall, or lengthy charges rise.

Two years in the past, the inversion of the yield curve—shorter-dated Treasurys yielding greater than longer-dated bonds—was taken by buyers as a surefire signal of recession. Now Wall Road worriers have a brand new concern: The yield curve is again to regular, a surefire signal of recession.

Right here’s a decomposition of the 10yr-2yr time period unfold (2s10s) change because the starting of June:

Determine 1: Change since June 1, 2024 in 10yr-2yr time period unfold (daring black), contribution to alter from 10 yr yield (blue bars), from 2 yr yield (tan), all in proportion factors. Supply: Treasury by way of FRED, and writer’s calculations.

Certain sufficient, barely greater than half of the steepening is related to a decline within the quick price. Evaluating to the the 2008 recession, we see the same sample.

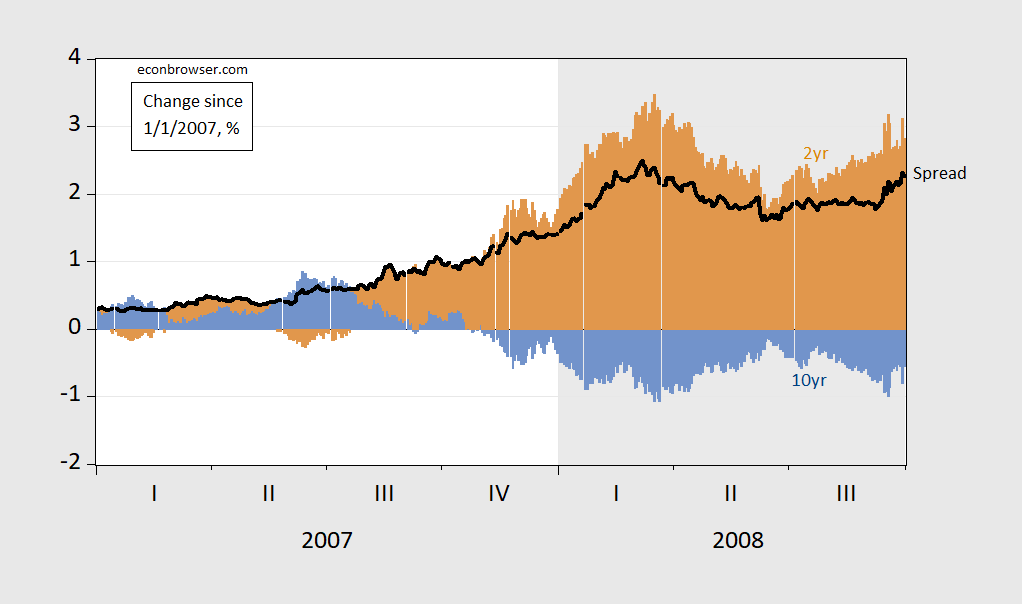

Determine 2: Change since January 1, 2007 in 10yr-2yr time period unfold (daring black), contribution to alter from 10 yr yield (blue bars), from 2 yr yield (tan), all in proportion factors. Supply: Treasury by way of FRED, and writer’s calculations.

The overwhelming majority of the steepening was because of the drop within the 2 yr yield (i.e., a “bear steepening”).

What in regards to the 2001 recession?

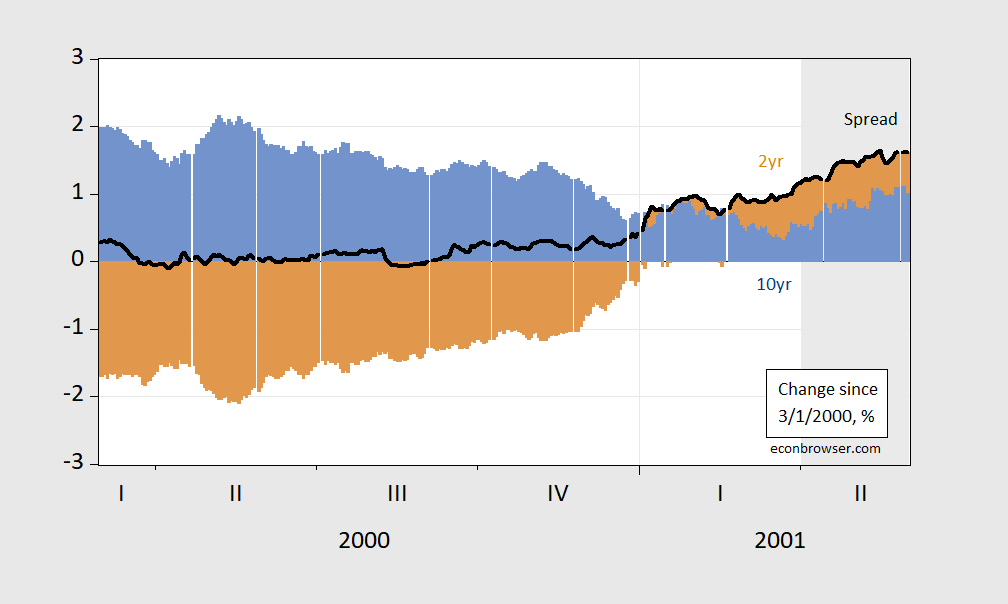

Determine 3: Change since March 1, 2000, in 10yr-2yr time period unfold (daring black), contribution to alter from 10 yr yield (blue bars), from 2 yr yield (tan), all in proportion factors. Supply: Treasury by way of FRED, and writer’s calculations.

Right here, now we have is perhaps known as a “bear steepening”, the place many of the time period unfold enhance was because of the lengthy price rising, till simply earlier than the recession’s begin, dated in April 2001 (since NBER places the height at March 2001).

So, none of that is to low cost the potential for an incipient recession — simply that one can’t essentially make a judgement primarily based on whether or not it’s quick charges falling, or lengthy charges rising.