As we speak, we’re lucky to have Willem Thorbecke, Senior Fellow at Japan’s Analysis Institute of Economic system, Commerce and Trade (RIETI) as a visitor contributor. The views expressed symbolize these of the creator himself, and don’t essentially symbolize these of RIETI, or another establishments the creator is affiliated with.

China’s merchandise exports elevated from $62 billion in 1990 to $3.6 trillion in 2022. In 1990, China’s exports equaled 1.9% of world exports and in 2022 its exports equaled 14.3% of world exports. China’s export juggernaut threatens corporations and jobs in importing international locations. How does the renminbi have an effect on China’s exports?

Cheung et al. (2012) examined how Chinese language mixture exports deflated utilizing the Hong Kong re-export unit worth index responded to the IMF CPI-deflated actual efficient change charge and to export-weighted actual GDP over the 1994-2010 interval. Using dynamic strange least squares (DOLS) estimation, they reported change charge elasticities which are appropriately signed and statistically important. These point out that if the renminbi have been 10% weaker, the regular state degree of exports can be between 9% and 16% increased.

How Trade Charges Might Have an effect on China’s Exports Now

Trade charges could not have an effect on China’s exports in recent times as they did in the course of the interval that Cheung et al. (2012) investigated. China’s export basket now consists of many extra superior merchandise resembling equipment, electronics, chemical substances, and autos than it did over the pattern interval that Cheung et al. investigated. As extra subtle items are more durable to supply than easy items, it’s more durable to seek out substitutes for these items than it’s for ubiquitous merchandise. Since discovering substitutes is more durable, worth elasticities needs to be decrease for advanced items.

As well as, Jean et al. (2023) discovered that China in 2019 possessed a share of greater than 50% of worldwide exports in 600 merchandise. This was six instances better than the U.S. or Japan and greater than twice as a lot because the European Union taken as an entire. They famous that when Chinese language exporters have a dominant market share in a product, it’s troublesome for importers to seek out substitutes. This might trigger the worth elasticity of demand for items the place China is dominant to be decrease.

Alternatively, extra of the value-added of the merchandise that China now exports comes from China. Xing (2021) documented the rise of Chinese language manufacturers producing cellphones. Branded corporations obtain extra of the return from items they produce than contract producers do. As well as, McMorrow (2024) confirmed that a lot of the value-added going into Huawei’s laptops now comes from China. Ahmed et al. (2016) and de Soyres et al. (2021) introduced proof indicating that the impression of change charges on exports will increase as extra of the value-added of the product is produced inside a rustic.

Time Sequence Proof on China’s Export Elasticities

It’s thus an empirical query whether or not change charges have a better impression on China’s exports in recent times than they did in earlier years. Chen Chen, Nimesh Salike, and I are investigating this query. First we use DOLS estimation and quarterly knowledge on China’s actual exports to the world over the 1994Q4-2023Q3 pattern interval. The dependent variables embrace the Financial institution for Worldwide Settlements CPI-deflated actual efficient change charge and actual GDP in OECD international locations. Minimizing Dickey-Fuller t-statistics and analyzing Dickey-Fuller autoregressive statistics level to a break within the export sequence in the course of the World Monetary Disaster. A dummy variable is about equal to at least one starting in 2009Q2. The dummy variable can also be interacted with a development time period and with the change charge.

The outcomes are introduced in Desk 1. Column (2) permits for a differential development and for a change within the change charge elasticity starting in 2009Q2. The coefficients on the true efficient change charge and the true efficient change charge interacting with a dummy variable equaling one beginning in 2009Q2 are each extremely statistically important. They point out that the change charge elasticity over the 1994-2009 interval equaled −1.36 and over the 2009-2023 interval −1.36+1.05 = −0.31. Thus a ten% renminbi appreciation would scale back exports by 13.6% over the sooner pattern interval and by solely 3.1% over the later pattern interval.

Column (3) presents outcomes over the 1994-2009 interval. The change charge elasticity is appropriately signed and better than unity in absolute worth. Column (4) presents outcomes over the 2009-2023 interval. The change charge coefficient is now insignificant and near zero.

Panel Information Proof on China’s Export Elasticities

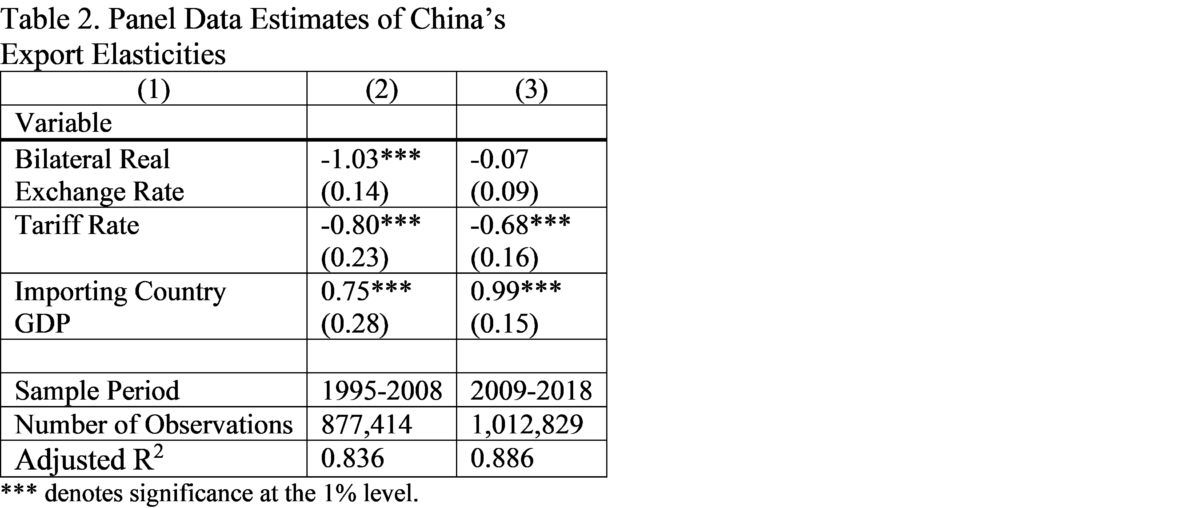

One shortcoming of the strategy reported in Desk 1 is that we don’t management for tariffs. We are able to do that utilizing the methodology of Bénassy-Quéré et al. (2021). They defined annual disaggregated bilateral exports utilizing a sequence of fastened results, the bilateral actual change charge between exporting and importing international locations, the pure logarithm of 1 plus the bilateral tariff on a product, and different variables. We make use of knowledge on China’s bilateral actual exports disaggregated on the Harmonized System four-digit degree for 1,242 export classes to 190 international locations over the 1995 to 2018 interval.

Desk 2 presents the outcomes over the 1995-2008 and 2009-2018 durations. Column (2) presents the outcomes for the sooner pattern interval and column (3) for the later pattern interval. Within the ancient times the coefficient on the change charge elasticity equals −1.03. This means {that a} 10% renminbi appreciation would scale back exports by 10.3%. The coefficient on the tariff charge equals −0.80. This means {that a} 10 % improve in tariffs would scale back exports by 8 %.

Within the later interval the coefficient on the change charge equals −0.07. This means that the change charge doesn’t have an effect on Chinese language exports over the 2009-2018 interval. The coefficient on the tariff charge equals −0.68. This means {that a} 10 % improve in tariffs would scale back exports by 6.8 %.

We additionally examine whether or not change charges impacted extra subtle merchandise in a different way over the later interval, utilizing the strategy of Hidalgo and Hausmann (2009) to measure sophistication. We discover that change charges didn’t impression exports both for easy or for advanced merchandise.

Conclusion

China’s exports have soared. Setser (2024) reported that China’s items commerce stability could also be 50% increased than reported within the Chinese language present account knowledge. China’s export juggernaut has generated tariffs overseas. Trade charge appreciations won’t assist to stabilize exports. Fairly than stoking protectionism, to rebalance commerce China ought to enhance home consumption and international locations just like the U.S. with outsized funds deficits ought to pursue fiscal consolidation.

References

Ahmed, S., Appendino, M., Ruta, M. 2015. World Worth Chains and the Trade Price Elasticity of Exports. IMF Working Paper No. 15–252, Worldwide Financial Fund, Washington DC.

Bénassy-Quéré, A., Bussière, M., Wibaux, P. 2021. Commerce and Forex Weapons. Overview of International Economics 29, 487-510.

Cheung, Y., Chinn, M., Qian, X. 2012. Are Chinese language Commerce Flows Completely different? Journal of Worldwide Cash and Finance 31, 2127-2146.

de Soyres, F., Frohm, E., Gunnella, V., Pavlova, E. 2021. Purchased, Bought and Purchased Once more: The Influence of Complicated Worth Chains on Export Elasticities. European Financial Overview 140, Article Quantity 103896.

Hidalgo, C., Hausmann, R. 2009. The Constructing Blocks of Financial Complexity. Proceedings of the Nationwide Academy of Sciences 106, 10570–10575.

Jean, S., Reshef, A., Santoni, G., Vicard, V. 2023. Dominance on World Markets: The China Conundrum CEPII Coverage Transient No 44, CEPII, Paris.

McMorrow, R. 2024. Huawei Laptop computer Reveals China’s Progress in direction of Tech Self-sufficiency. Monetary Occasions, 24 September.

Setser, B. 2024. The IMF’s Newest Exterior Sector Report Misses the Mark. Observe the Cash Weblog, 26 August.

Xing, Y. 2021. Decoding China’s Export Miracle: A World Worth Chain Evaluation. World Scientific, Singapore.

This put up written by Willem Thorbecke.