At the moment, we current a visitor submit written by Charles Engel, Donald D. Hester Distinguished Chair in Economics at UW Madison and Steve Pak Yeung Wu, Assistant Professor of Economics at UCSD.

It’s usually believed that customary macroeconomic empirical fashions of international trade charges don’t match the information nicely. (See for instance, Meese and Rogoff (1983), Cheung, et al. (2005), and Itskhoki and Mukhin (2021).) Nonetheless, we discover that these fashions match very nicely for the U.S. greenback within the 21st century. A “standard” mannequin that features actual rates of interest and a measure of anticipated inflation for the U.S. and the international nation, the U.S. complete commerce steadiness, and measures of world danger and liquidity demand is well-supported within the information for the U.S. in opposition to different G10 currencies. The “monetary variables” (that’s, actual rates of interest and anticipated inflation) and non-monetary variables play equally essential roles in explaining trade price actions. Within the Nineteen Seventies – early Nineties, the match of the mannequin was poor, however the mannequin efficiency has improved steadily to the current day. We make the case that it’s higher financial coverage (inflation focusing on) that has led to the advance, because the scope for self-fulfilling expectations has disappeared. We offer quite a lot of proof that hyperlinks adjustments in financial coverage to the efficiency of the exchange-rate mannequin.

The hyperlink to the working paper is right here. This observe leaves out the technical particulars and references to the literature, that are within the paper. We look at the determinants of the greenback relative to the euro, the U.Okay. pound, the Canadian greenback, the Australian greenback, the New Zealand greenback, the Norwegian krone, and the Swedish krona. The Japanese yen and Swiss franc are particular circumstances which we deal with individually.

The empirical mannequin hyperlinks adjustments in bilateral month-to-month trade charges to:

- Actual rates of interest within the U.S. and the “foreign” nation. Most macro fashions of trade charges posit {that a} larger actual rate of interest induces a stronger foreign money. A rise within the U.S. actual rate of interest leads the greenback to understand, and the next international actual rate of interest is related to a greenback depreciation.

- Inflation. Maybe paradoxically, larger inflation within the U.S. ought to result in a greenback appreciation (and better international inflation to a greenback depreciation.) That is the conclusion of the New Keynesian macroeconomic paradigm when financial coverage is credible. Increased inflation (over the previous 12 months) leads central banks that concentrate on inflation to tighten. Since we already management for actual rates of interest, that are decided by the present stance of financial coverage, this channel captures expectations of future financial coverage actions.

- Commerce steadiness on items and companies within the U.S. Because the commerce deficit will increase, the U.S. internet international asset place deteriorates. Particularly within the early 21st century, markets grew to become involved that insurance policies could be undertaken to weaken the greenback to cut back the worth of exterior debt, so larger commerce deficits are related to a depreciating greenback.

- World danger. The greenback is taken into account a “safe-haven” foreign money. Throughout occasions when world danger is excessive (as measured right here by bond market spreads), the greenback strengthens.

- Liquidity. Additionally, throughout occasions of world stress, markets improve demand for greenback liquid belongings. As that demand rises, the “convenience yield” on U.S. Treasury belongings will increase, and the greenback appreciates.

- Buying Energy Parity. When the relative buying energy of the greenback may be very misaligned, there’s a (weak) tendency to return to the PPP degree.

Mannequin Estimation

The mannequin is estimated currency-by-currency and in addition collectively by panel estimation. The macro variables usually have the signal and magnitude according to financial principle and are normally fairly statistically vital when estimated over the January 1999 to August 2023 interval. (The place to begin right here is chosen as a result of it corresponds to the arrival of the euro.) Determine A proven right here plots the “fitted values” of the mannequin in opposition to the precise trade price.

Particularly, for the reason that mannequin is estimated for the month-to-month change within the trade price, the fitted worth for the degrees that’s plotted right here cumulates the mannequin’s estimated change every month to provide the mannequin’s match for the extent of the (log of) the trade price. The preliminary worth within the cumulation is chosen to make the general common of the fitted values equal the general common within the information.

One factor to be very clear about right here is that we’re not forecasting trade charges. The empirical mannequin makes use of information from, for instance, January 2000 to clarify the January 2000 trade price. Even when the macroeconomic fashions of trade charges are good fashions, they in all probability aren’t helpful fashions for forecasting. Principally, trade charges change from month to month due to unanticipated adjustments in explanatory variables. However these unanticipated adjustments can’t, by definition, be forecast, so forecasting the change in trade charges turns into very troublesome even with one of the best mannequin in hand.

The Mannequin Suits

Turning to Determine A, taking the euro trade price for example, the fitted values reproduce nicely the preliminary appreciation of the U.S. greenback from 1999-2000, adopted by the depreciation of the U.S. greenback from 2001 to 2008. The fitted sequence additionally matches the sharp appreciation of the U.S. greenback in 2008, 2010, and 2013. Each the information and the fitted sequence exhibit an appreciation of the greenback from 2013 onwards. The model- implied sequence additionally suits the sample post-2020 very nicely, mimicking the V-shape from 2021 to 2023. The shut correspondence between the pink line and the blue strains holds for all different currencies in numerous sub-periods between 1999 and 2023.

Determine A: Evaluating information and mannequin implied trade charges

The Match has Improved over Time

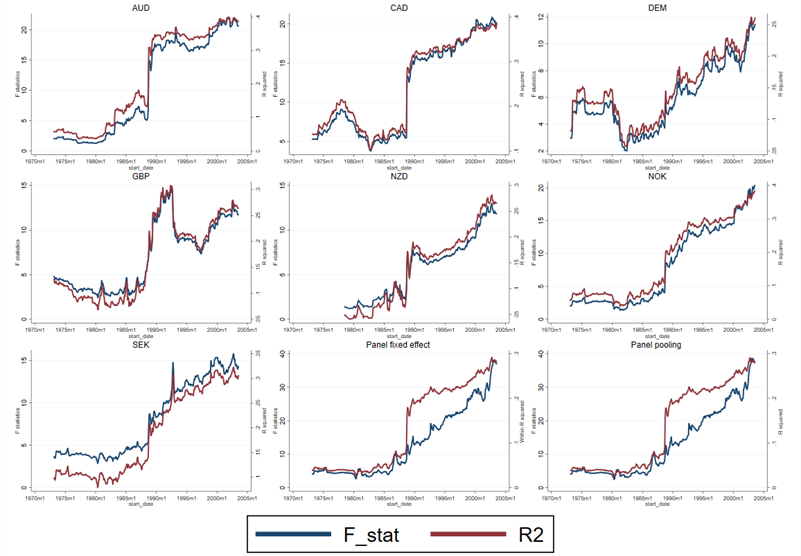

However the mannequin didn’t match over earlier samples. We doc this by estimating the mannequin over 20-year rolling samples starting in 1973. Within the earlier samples, the match was poor – the variables are normally statistically insignificant; generally when they’re vital, they’ve the fallacious signal; and the R-squared values are low. F-tests of the joint significance of the explanatory variables fail to reject the null. However there’s a near-monotonic improve within the F-statistics and R2s because the samples progress in time, and these statistics primarily attain their most within the remaining 20-year pattern. Determine B plots the R-squared and F statistics over time from these rolling regressions. It reveals that the fashions match poorly within the early samples, however that the match has steadily improved.

Why the Mannequin Didn’t Work within the Outdated Days

What accounts for the poor match of the fashions within the precedent days, and the superb match now? We argue {that a} change in financial regime could clarify this. As we present, financial principle implies that when central banks don’t observe a reputable inflation-targeting coverage, there may be scope for self-fulfilling expectations to affect variables within the financial system, together with inflation, output, and trade charges. Intuitively, suppose markets conjure up a perception that inflation will likely be larger. If central banks don’t reply forcefully sufficient to this alteration in expectations, actual rates of interest will fall. That may stimulate combination demand, result in inflation and a weaker foreign money. We contend that as credibility elevated, this phenomenon decreased, and the match of the usual mannequin improved. When financial coverage is credible, an expectation of inflation whipped up out of skinny air won’t be sustained as a result of tighter financial coverage will rapidly be seen to get rid of the chance of future inflation.

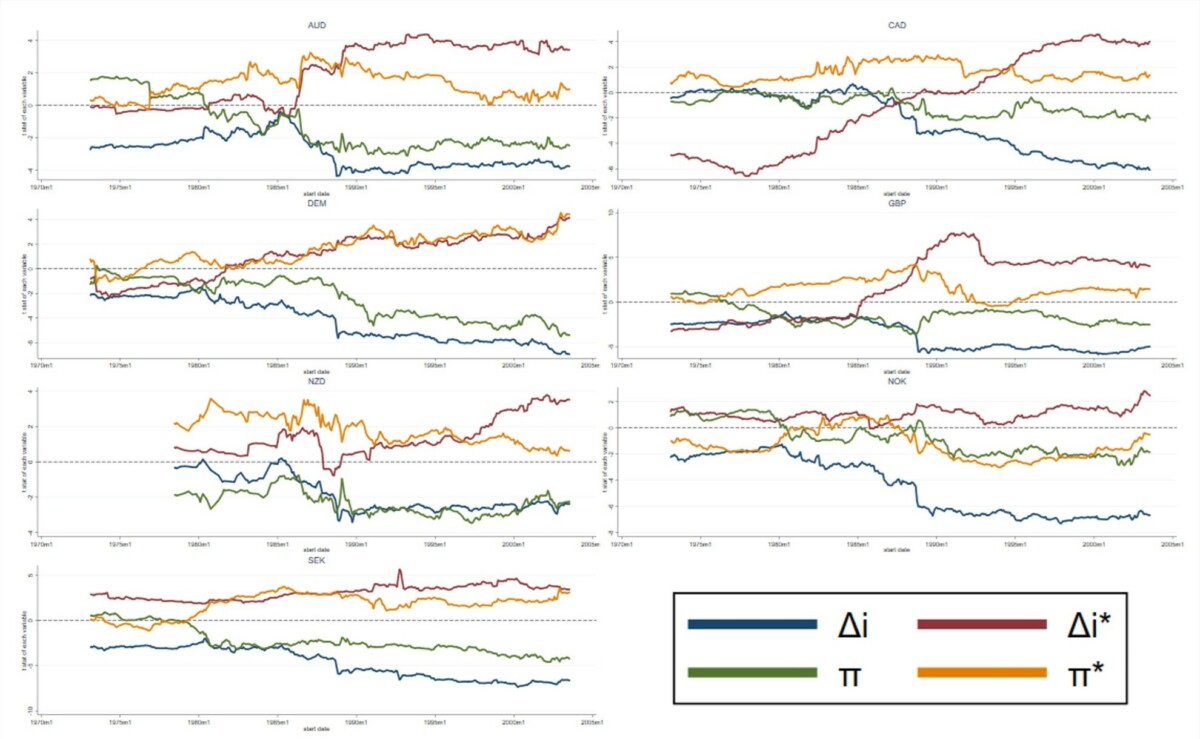

That the advance in match is expounded to the financial variables is clear in Determine C, which plots the t-statistics for the true rate of interest variables (Δi, Δi*) and the measures of inflation (π and π*) from rolling 20-year regressions. The t-statistic measures the contribution of the variable (the estimated regression coefficient) scaled by the precision of the estimate (the inverse of the usual error of the estimate), so it provides us a good suggestion of how essential every variable is in explaining trade price actions. In these graphs, if the speculation is right, the t-statistics must be destructive for the U.S. interest-rate and inflation variables and constructive for the international variables. Values which can be above roughly 2.0 are statistically vital. We will see from Determine C, with a couple of exceptions, that the variables had been hardly ever vital within the early a part of the pattern and sometimes had the fallacious signal, however within the later samples, they’ve the precise signal and are vital.

The rate of interest and inflation variables are essential as a result of they point out whether or not financial coverage trade charges are responding to credible financial insurance policies. If insurance policies are credible, larger actual rates of interest ought to make the foreign money stronger, and better inflation ought to sign future insurance policies will likely be tighter and in addition will respect the foreign money. That sample doesn’t maintain within the earlier samples however does within the later samples.

Determine B: F-statistic and R-squared of 20-year rolling window regressions

Determine C: t statistics of 20-year rolling window regressions

Financial coverage for the U.S. started to shift throughout the Volcker period, in order that Taylor guidelines estimated on information starting within the mid-Eighties supply assist for financial stability. The superior nations in our pattern adopted inflation focusing on a couple of years later: New Zealand in 1990, Canada in 1991, the U.Okay. in 1992, Sweden and Australia in 1993, Norway in 2001. One of many pillars of European Central Financial institution coverage, starting in 1999, is inflation focusing on. Germany formally adopted inflation focusing on in 1992 earlier than the arrival of the euro, although focusing on inflation was all the time on the core of Bundesbank coverage.

The paper produces additional proof to assist the shift in financial coverage in these nations and its gradual growing credibility. The essential contribution right here is that the success of the empirical mannequin doesn’t rely solely on the chance and liquidity variables, that are essential in monitoring the actions of the greenback throughout occasions of world monetary stress. The variables that symbolize the stance of financial coverage within the U.S. and the opposite nations are key to accounting for the great match of the mannequin at present and its poor match previously. It’s pure to attribute this alteration over time to the altering nature of financial coverage.

Empirical Trade Fee Fashions are Higher than You Suppose

Clearly, the match of the mannequin will not be good. There could certainly be different components driving trade charges, together with non-market “noise trading” that has been emphasised in some latest research. Nonetheless, it’s seemingly {that a} main purpose the match will not be good is as a result of economists can’t completely measure the variables that principle says ought to drive the trade price: the stance of financial coverage, the extent of world danger, the demand for liquidity, and so on. Determine A definitely reveals that the empirical mannequin is ready to seize main components driving greenback trade charges.

This submit written by Charles Engel and Steve Pak Yeung Wu.