Advert hoc time sequence evaluation.

The 30 12 months mortgage price and 10 12 months Treasury fixed maturity yield comove over the previous 8 years. A Johansen most chance check (fixed in cointegrating equation, in VAR, 4 lags of variations) rejects the no cointegration null utilizing the Hint statistic (additionally only one cointegrating vector, so each sequence is likely to be stationary) over the 1986-2024M08 interval.

The null speculation of (1 -1) cointegrating vector just isn’t rejected (level estimates (1 -1.02).

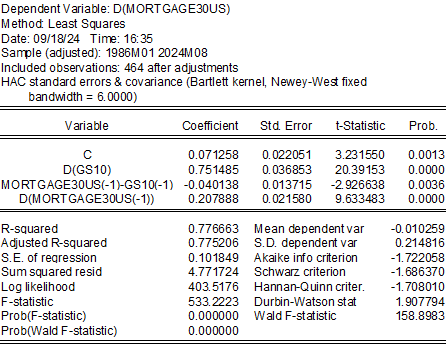

Utilizing a single equation error correction mannequin (imposing homogeneity) yields:

These estimates point out mortgage charges are about 7 ppts above 10 12 months Treasurys. A one share level discount within the 10 12 months yield leads to a 0.75 share level discount in mortgage charges upon impression (right here, in month). Deviations from equilibrium have a half reside of about 4.5 years.

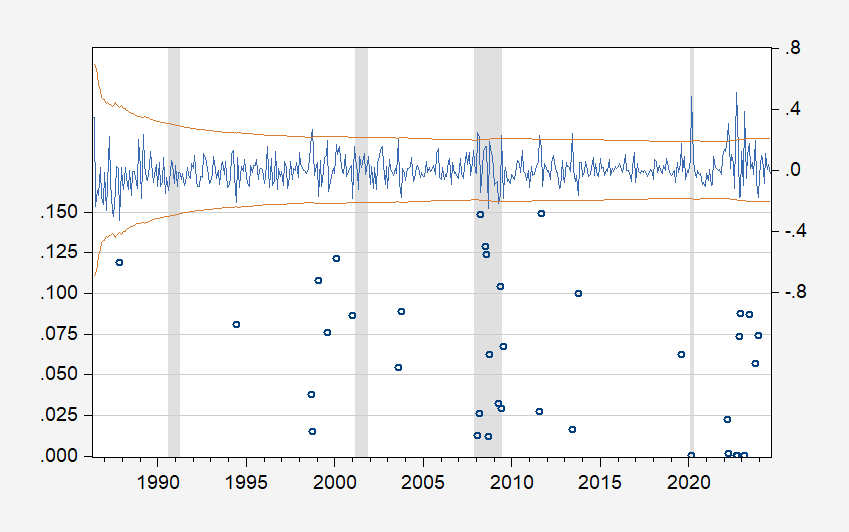

The connection is topic to structural breaks, as indicated by recursive one-step forward Chow assessments, significantly round September 2022.

Determine 1: Likelihood for recursive Chow one-step forward check for no break (left scale), recursive residuals (proper scale). NBER outlined peak-to-trough recession dates shaded grey.

If 100 bps discount within the Fed funds price (at present the discuss for end-of-year) leads to about 30 bps discount within the ten 12 months, this means about 23 bps discount in mortgage charges by 12 months’s finish (ballpark!).