Readers [1] [2] inquired why there seems to be a pattern break in (log) CPI at 2022M06. My greatest guess is the spike in oil costs.

Determine 1: CPI (blue, left scale), core CPI (tan, left scale), and WTI oil value (daring black, proper scale), all in logs, 2022M02=0. Supply: BLS, EIA through FRED, and writer’s calculations.

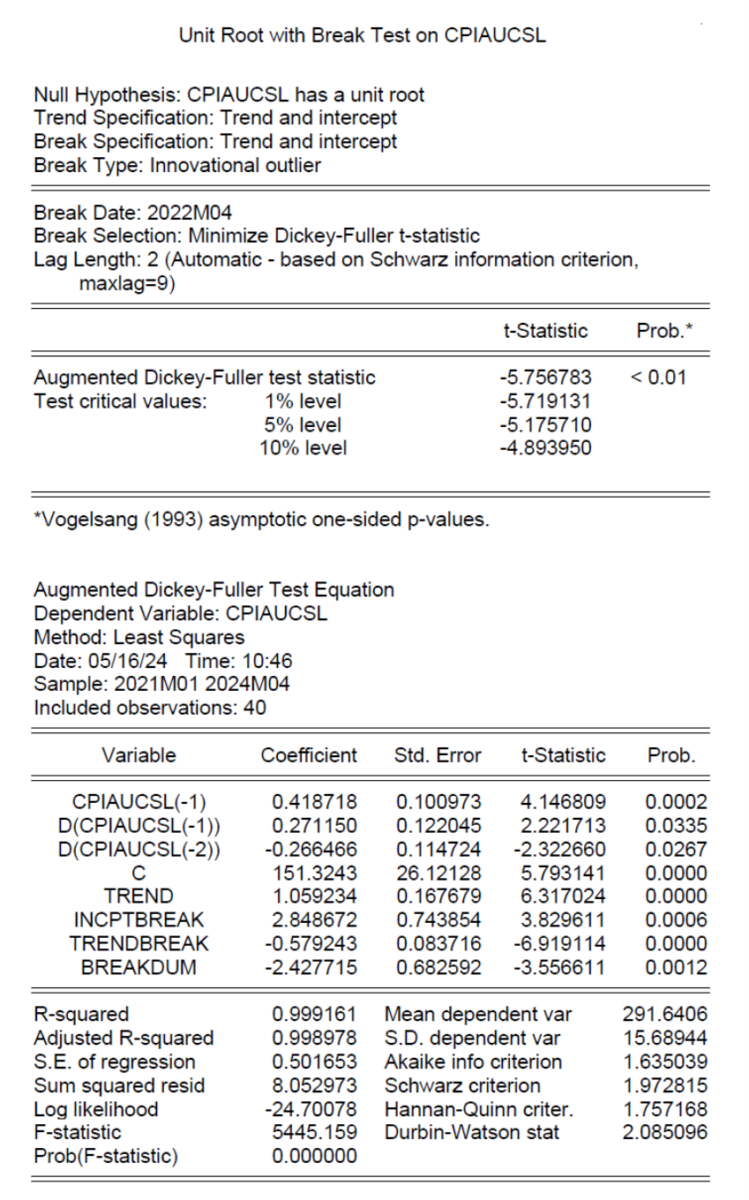

Whereas the CPI pattern breaks at 2022M06, matching the height in oil costs, core CPI doesn’t such proof. Utilizing a unit root break take a look at (Perron, 1997) identifies a pattern and intercept break at 2022M04.

Word that there’s a break in core CPI as nicely, though the identical take a look at finds a break at 2023M01.

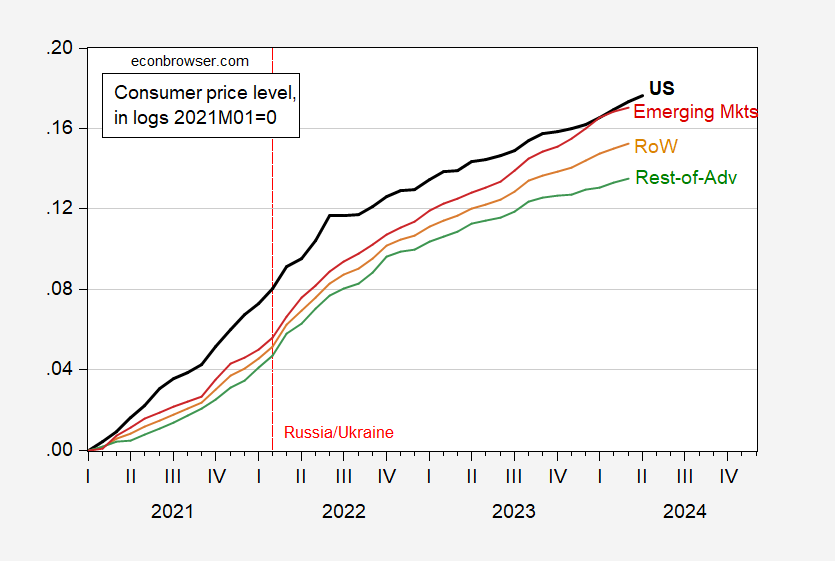

For the world, there’s a comparable sample:

Determine 2: US CPI (daring black), rest-of-world (tan), rest-of-advanced nations (inexperienced), rising markets (pink), all seasonally adjusted, in logs 2021M01=0. Supply: BLS, Dallas Fed DGEI, and writer’s calculations.