A reader sends me a missive with this line, and (amongst others) an image of producing employment. I reproduce (on an annual foundation) this collection again to 1960 within the determine beneath.

Employment in manufacturing did take a plunge in 2001. I didn’t realize it was going to take fairly the plunge it did, however I did see employment declining (then serving on CEA).

Determine 1: Manufacturing employment, manufacturing & nonsupervisory, 000’s (blue, left log scale), and manufacturing worth added in bn.Ch.2017$ (black, proper log scale). Supply: BLS, BEA.

Worth added rises. Why? Specialization in excessive worth added elements of worth chains (cf worldwide textbooks) as predicted by comparative benefit in duties.

Mechanically, how can these traits in employment and worth added do what they do? Properly, it’s because of one thing referred to as “productivity”. The identical purpose why employment in agricultural manufacturing (not processing, however farming and many others.) is down but worth added output is up.

Simply sayin’.

The reader additionally feedback:

Simply coincidentally and by no means associated to any of this, China’s economic system and rise as a navy energy soared concerning the flip of the century… or so we’re alleged to imagine.

The drop in manufacturing employment is not, for my part, unrelated to the entry of China into the world buying and selling system. Comparative benefit would counsel reallocation ought to happen (positive factors from commerce happen due to modifications in consumption and manufacturing, in spite of everything). And there’s little doubt China has developed as a financial energy and strategic competitor. On the second level, I wouldn’t be writing all these posts on PRC actions round Taiwan.

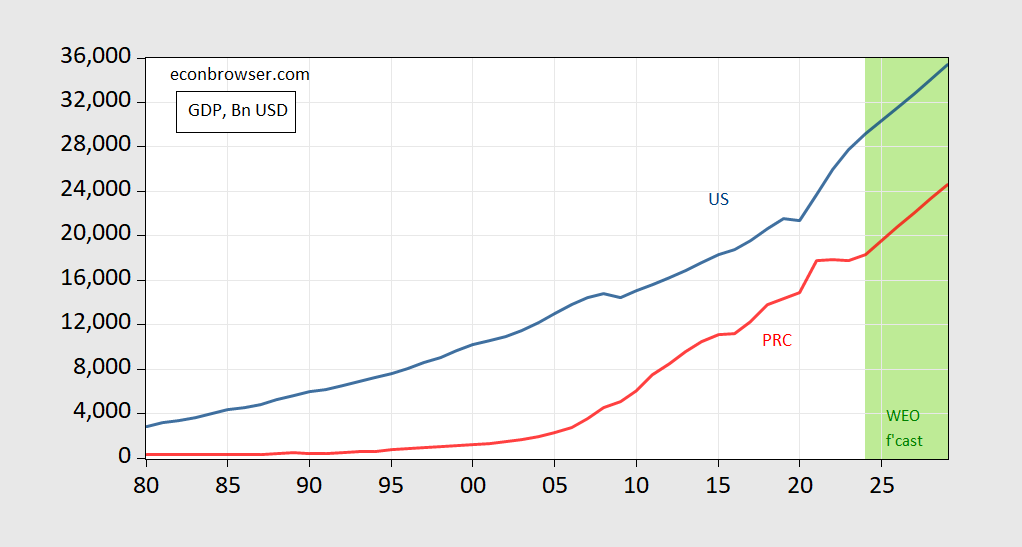

However good to maintain issues in thoughts. First, the US stays the world’s largest economic system evaluated at market trade charges.

Determine 2: US GDP (blue), China (pink), in bn. US$. Supply: IMF WEO (October).

There isn’t any longer a projected crossover, as had been projected in earlier years.

Whereas PPP {dollars} can be extra helpful for evaluating requirements of residing, market charges are extra for contemplating financial energy on the planet economic system, and skill to undertaking affect. What about per capita in PPP Worldwide $?

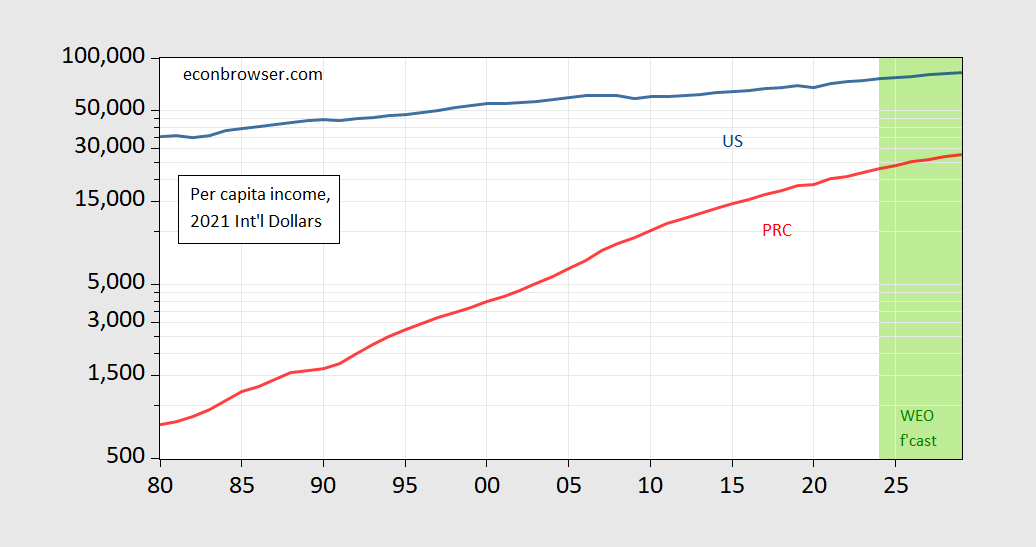

Determine 3: US GDP per capita (blue), China per capita (pink), in bn. PPP 2021 Worldwide$ . Supply: IMF WEO (October).

Exhausting to see speedy convergence in PPP per capita.

This doesn’t imply China doesn’t have actual world financial impression. I’d simply say we need to preserve issues in perspective.