By Menzie Chinn and Mark Copelovitch

A Harris administration is much much less prone to disrupt the continued and unprecedented American financial restoration of the final three years with stark coverage reversals. That is an expanded model of an op-ed revealed within the Milwaukee Journal Sentinel.

For the 2024 presidential election, American voters face two starkly totally different paths for the financial system.

The primary one is a path towards additional financial isolationism, deregulation, and tax cuts for prime revenue households financed by large authorities deficits. The opposite is a street that helps the center class via tax insurance policies, retains engagement within the worldwide financial system, and invests sooner or later with spending on infrastructure and new factories. This second alternative builds upon the trail that has led to speedy and broadly shared progress during the last 3½ years.

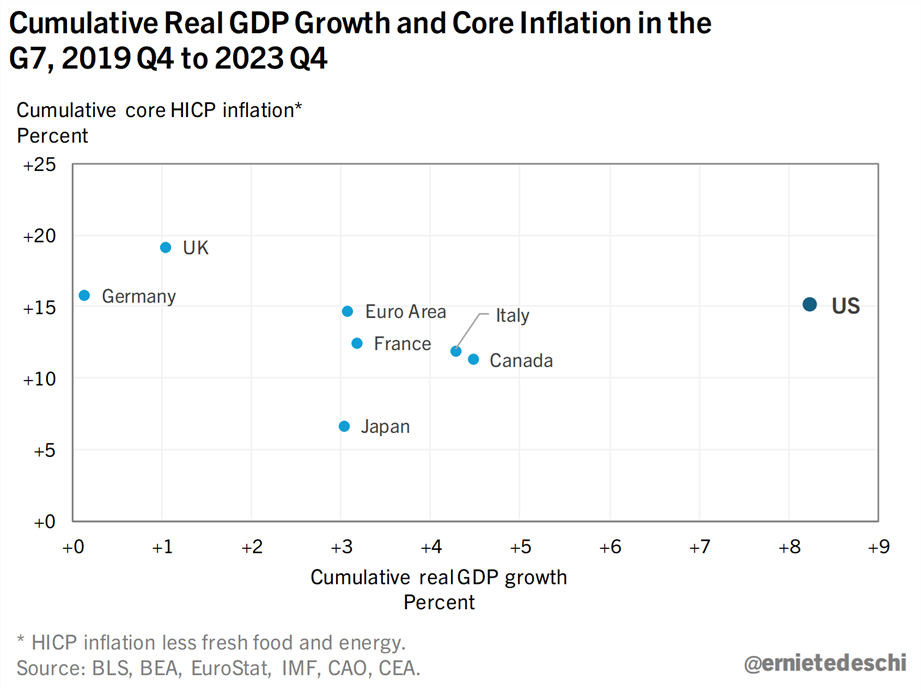

Regardless of the financial turmoil and inflation attributable to the worldwide pandemic and the warfare in Ukraine, the U.S. financial system has skilled an unprecedented speedy and profitable restoration within the final three years. Within the yr ending final quarter, GDP grew at 3%, whereas unemployment was at a close to document low of three.4% (January 2023). Among the many giant industrial nations, the U.S. restoration has far outstripped that of our G7 counterparts because the pandemic’s onset.

What’s most spectacular concerning the U.S. progress is that it has come with none extra inflation over and above that of our G7 friends. That is additional proof that the first drivers of inflation, within the U.S. and elsewhere, have been international shocks (the pandemic, the warfare in Ukraine), fairly than the results of the Biden administration’s fiscal coverage. It seems that the standard knowledge within the U.S. in 2022-23, which entailed numerous pessimistic headlines concerning the financial system and blamed Joe Biden’s fiscal coverage for being the first reason for inflation, was not fairly proper.

Financial restoration in U.S. outstrips different G7 nations

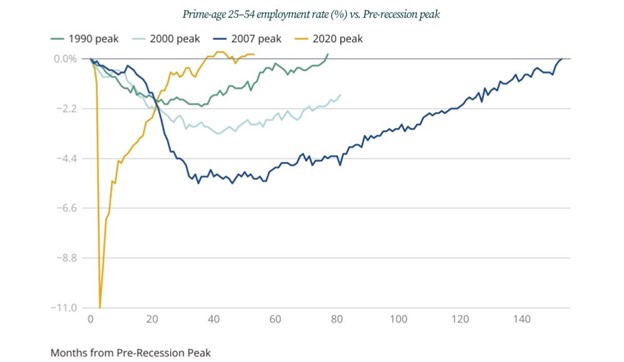

The US restoration has not solely been spectacular relative to different nations. It has additionally been traditionally unprecedented in American historical past. After the beginning of the International Monetary Disaster in 2008, it took greater than a decade to return to pre-crisis ranges of unemployment. America really skilled a “Lost Decade,” which some estimates have calculated price the common family tens of hundreds of {dollars} in lifetime revenue loss. In distinction, the U.S. restoration from COVID-19 has been terribly quick and full. Employment is larger now than in 2020, and the restoration took solely three years.

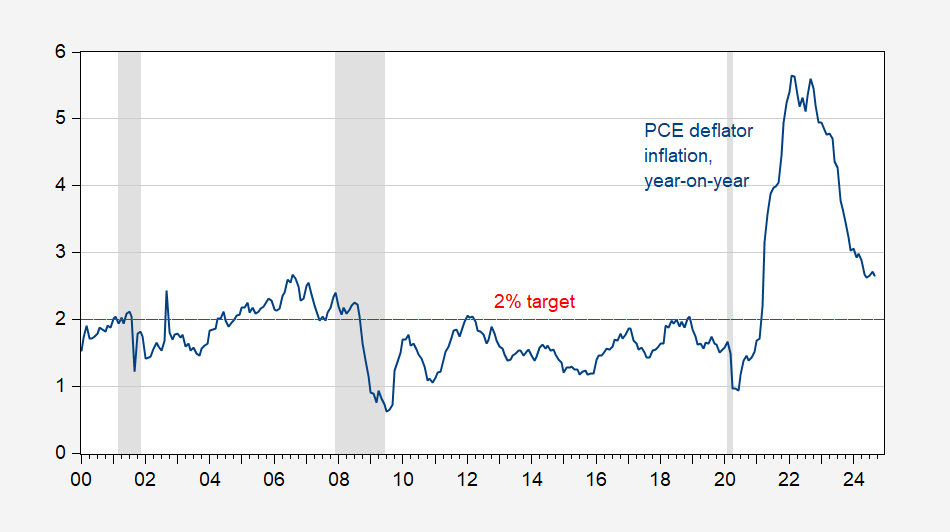

As well as, the inflation shock is mainly now over. Within the newest August depend, inflation was 2.6%. If that sounds too excessive, by comparability, within the final month earlier than the pandemic struck (January 2020), inflation was 2.5%. The Federal reserve targets 2% inflation. We are actually nearer to that concentrate on than we had been for a lot of the final 20 years, after we systematically undershot the mark by a large margin.

At this time’s low and near-target inflation defies most of the predictions made throughout the peak of the pandemic. In 2022, distinguished consultants, akin to Larry Summers, made grim forecasts predicting stubbornly excessive inflation that might have to be overwhelmed down through years excessive unemployment. We’ve got prevented this final result, and the Fed has seemingly achieved the a lot desired “soft landing.” Furthermore, whereas value ranges have elevated about 20% because the begin of the pandemic in 2020, actual (inflation-adjusted) revenue per capita has elevated by practically 9% and is now again on pre-pandemic development.

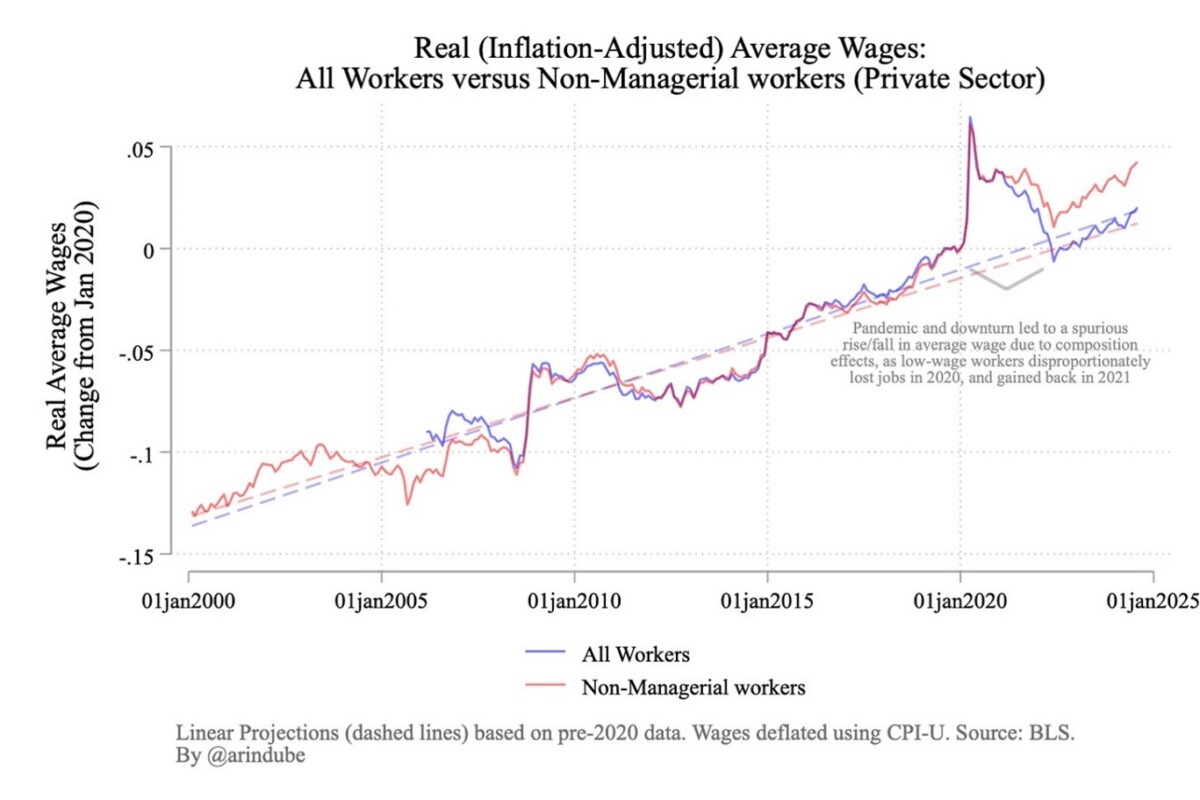

To make certain, inflation has distributional prices and this progress has not been equally shared. Nonetheless, these on the lowest rungs have truly gained, fairly than misplaced, in comparison with these higher off. This may be seen by wanting on the weekly earnings of these within the backside quarter of the revenue distribution, adjusted for inflation, in comparison with the median. Likewise, we will see this when have a look at actual wages, which have grown considerably sooner for “regular” (non-managerial) staff than for all staff, which incorporates executives and different extra highly-paid professionals.

Put merely, regardless of the worldwide shocks and the inflation since 2020, the financial system is in glorious form, the common American voter is doing considerably higher now than 4 years in the past, and inequality is declining in America as wage and revenue progress on the backside of the revenue distribution are rising sooner than on the prime. This actuality runs counter to the doom-and-gloom narrative many people accepted over the previous couple of years.

Trying ahead over the subsequent two months and into 2025, barring sudden occasions just like the outbreak of a serious army battle, few economists see a recession. With rates of interest falling, borrowing will grow to be simpler, notably for these hopeful homebuyers.

All these optimistic developments are in danger, relying upon the alternatives we make in November.

Trump and Harris campaigns current divergent financial plans

The financial proposals of the 2 presidential candidates, to the extent that we all know them, differ considerably. The financial insurance policies that Republican nominee Donald Trump has supplied sometimes have a lot much less element than the corresponding plans from Vice President Kamala Harris, the Democratic candidate.

For Trump, we’ve got full extension of the tax price reductions within the Tax Cuts and Jobs Act of 2017, an extra company tax discount, and the elimination of taxes on ideas. Extra specifics have been supplied for mass deportations of undocumented (and apparently documented) immigrants, in addition to an across-the-board 10% (or 20%) tariff price, with 60% tariffs on Chinese language merchandise and 200% on John Deere tools produced in Mexico.

In distinction, Harris has proposed a set of tax breaks that embody components of the TCJA, growth of the Baby Tax Credit score, a tax credit score for first-time homebuyers at the side of incentives to extend inexpensive housing.

We perceive that it’s usually simpler stated than executed in immediately’s extremely polarized political local weather, however we nonetheless consider within the worth of utilizing evidence-based evaluation to information views on what’s greatest for our nation by way of financial coverage. To guage these measures proposed by the candidates, one has to take note of each the prices, and the advantages.

Trump’s financial plans will price considerably greater than Harris’

We will depend the candidates’ proposed tax measures’ prices for the taxpayers pretty simply. For Trump’s plans, economists have calculated a value of about $3 trillion over 10 years. For Harris, the quantity is about $1.4 trillion. A more moderen tabulation of the price of Trump’s guarantees is $11 trillion over 10 years, as he has expanded the variety of tax breaks he has promised

There are additionally non-budgetary prices. Within the case of Trump’s tariff plans, the near-unanimous opinion of economists is that his proposed across-the-board tariffs would result in a catastrophe. Right here the proof will not be so fuzzy. The tariffs of 2018-19 led to elevated prices — not just for American companies that used metal, aluminum and different imported items — but in addition for American shoppers. Furthermore, as prices elevated, the tariffs didn’t even assist manufacturing, costing the sector 175,000 jobs, on web. With each imported good topic to at the very least a ten% tariff, the financial system would doubtless shed progress, maybe going into recession (notably if our buying and selling companions retaliate).

Moreover, America’s farm exports dropped precipitously resulting from retaliation by our buying and selling companions. Solely by advantage of a authorities bailout with authorities funds, to the tune of over $12 billion, had been farmers’ fortunes saved. A key factor to bear in mind with respect to this promise to start out a brand new commerce warfare is that for most of the proposed commerce measures, Trump doesn’t want Congress’s approval.

Equally unfavourable assessments have additionally been reported for Trump’s said plans to pursue mass deportation insurance policies focusing on each authorized and undocumented immigrations. One current estimate from the American Immigration Council notes that such insurance policies might price over $300 billion and scale back U.S. GDP by 4.2% to six.8%, a shock to the financial system much like that of the Nice Recession.

Even when solely restricted to post-2020 arrivals, these mass deportations would undoubtedly depress financial exercise considerably. In fact, this doesn’t even start to the touch on the human price of such a draconian strategy to immigration that might doubtless tear on the cloth of communities throughout the nation.

Harris plan would proceed progress, Trump’s would spur larger costs

In distinction, the insurance policies proposed by Harris would virtually actually assure a extra secure and affluent financial system. In avoiding a extra escalated commerce warfare, the U.S. and international financial system would doubtless proceed to develop. Furthermore, her tax proposals are aimed toward decreasing financial inequality (as within the growth of the Earned Revenue Tax Credit score), and towards investing in human capital by means of the expanded Baby Tax Credit score. The earlier Baby Tax Credit score growth, which was enacted throughout the pandemic, lower baby poverty practically in half. Therefore, we’ve got strong empirical proof that each of those tax measures will assist scale back poverty and revenue inequality.

On the similar time, Harris has proposed retaining a majority of tax cuts from the 2017 Tax Cuts and Job Acts, particularly these aimed toward decrease and center revenue teams. These are the large ticket funds gadgets, which might largely be offset by tax will increase on larger revenue households and companies.

Extra focused, however nonetheless essential, measures would barely make a noticeable impression on the funds. As an example, the housing credit score for first time homebuyers, coupled with measures to develop the housing provide, might make a big impression on housing affordability. Proposals to forestall value gouging by suppliers of groceries, by means of anti-trust actions, would have basically no fiscal impression, however nonetheless assist to maintain residing prices down.

Analyses by unbiased analysis teams, akin to Goldman Sachs, Moody’s, Peterson Institute for Worldwide Economics, point out that implementation of the majority of the Trump financial agenda, even when excluding full-fledged mass deportations of immigrants, would result in slower financial progress throughout the yr.

Nonetheless, the Goldman Sachs and Moody’s analyses estimate a optimistic impression for the Harris agenda. Furthermore, as a result of progress could be slower, and deficits bigger, the federal debt would rise sooner below Trump than below Harris. Moreover, inflation, spurred by tariffs, would additionally rise sooner below Trump.

On the idea of economics, the selection is obvious, at the very least for these not within the prime 10% in revenue and wealth. The price of residing, unemployment, and authorities debt would all be larger below a Trump administration. Even those that would possibly acquire from tariffs would possibly very nicely lose out in the long run, ought to Trump’s tariffs spur retaliation and set off a broader commerce warfare with China and different main buying and selling companions.

Alternatively, a Harris administration would pursue financial insurance policies that might largely profit vast swaths of the American inhabitants. And whereas the long run is unsure, a Harris administration is much much less prone to disrupt the continued and unprecedented American financial restoration of the final three years with stark coverage reversals that create new uncertainty about our nationwide financial insurance policies and our financial ties to our closest allies and main buying and selling companions.

Menzie Chinn is a professor of public affairs and economics in UW-Madison’s La Follette Faculty of Public Affairs and Division of Economics. Mark Copelovitch is a professor in UW-Madison’s La Follette Faculty of Public Affairs and Division of Political Science.