by Calculated Danger on 5/27/2024 09:21:00 AM

Altos stories that lively single-family stock was up 2.9% week-over-week. Stock is now up 20.3% from the February backside, and on the highest degree since August 2020.

Click on on graph for bigger picture.

This stock graph is courtesy of Altos Analysis.

As of Might twenty fourth, stock was at 595 thousand (7-day common), in comparison with 578 thousand the prior week.

Stock continues to be far beneath pre-pandemic ranges.

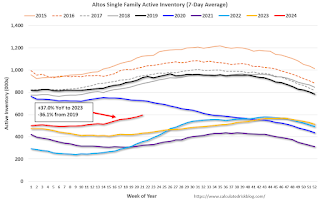

The second graph reveals the seasonal sample for lively single-family stock since 2015.

The crimson line is for 2024. The black line is for 2019. Word that stock is up 84% from the report low for a similar week in 2021, however nonetheless effectively beneath regular ranges.

Stock was up 37.0% in comparison with the identical week in 2023 (final week it was up 36.0%), and down 36.1% in comparison with the identical week in 2019 (final week it was down 36.4%).

Again in June 2023, stock was down virtually 54% in comparison with 2019, so the hole to extra regular stock ranges is slowly closing.