108.7 vs. 99.5 (Bloomberg consensus). Is optimistic financial information percolating into surveys? From the Confidence Board at present:

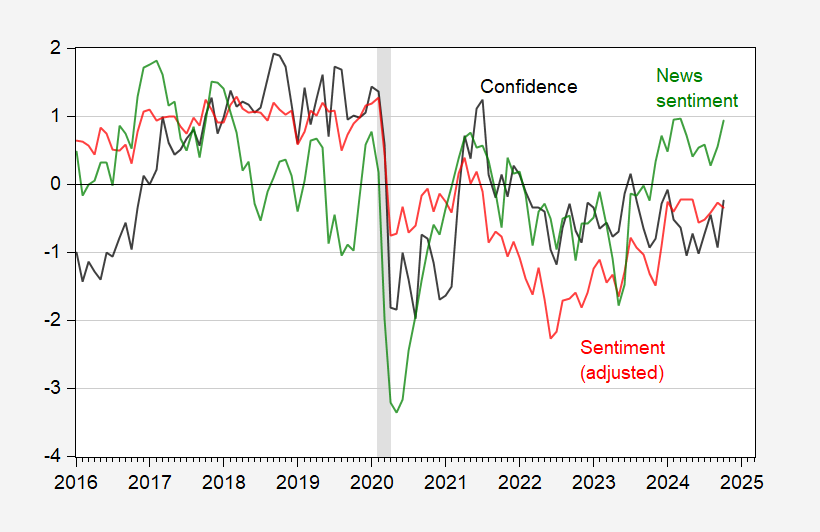

Determine 1: UMich Shopper Sentiment (blue, left scale), Shopper Sentiment adjusted per Cummings-Tedeschi (pink, left scale), and Convention Board Shopper Confidence (black, proper scale), Bloomberg consensus (gentle blue sq., proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: College of Michigan through FRED, Convention Board, NBER.

Taking into consideration the adjusted UMich Shopper Sentiment index (per Cummings and Tedeschi (2024) mentioned right here) and the Convention Board Shopper Confidence index, shopper assessments of the economic system are noticeably brighter than in earlier readings.

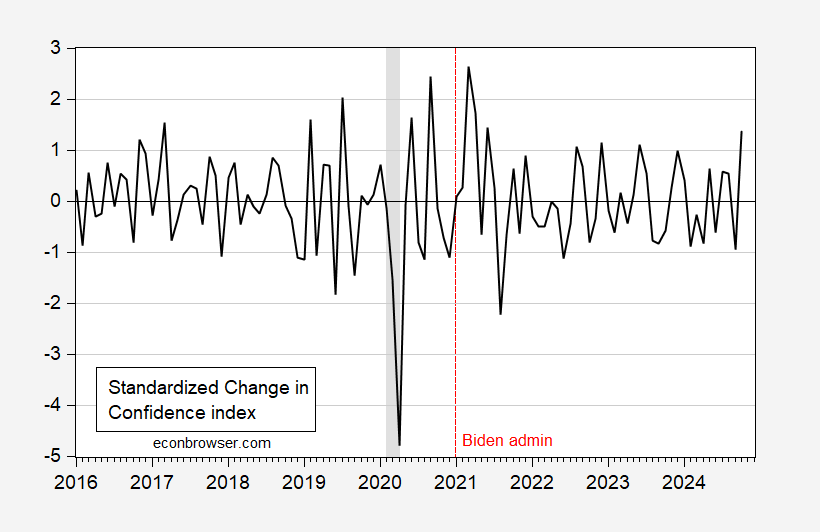

The change within the Confidence index is fairly giant (which is attention-grabbing when taken along with the optimistic revision to the September worth).

Determine 2: Change in Convention Board Shopper Confidence demeaned and normalized by normal deviation 2016-2024M10 (blue). NBER outlined peak-to-trough recession dates shaded grey. Supply: Convention Board, NBER and creator’s calculations.

The normalized change is 1.4 normal deviations – over a interval marked by substantial actions.

Lastly, with these readings, the hyperlink to information sentiment is re-established to some extent.

Determine 3: UMich Shopper Sentiment adjusted per Cummings-Tedeschi (pink), and Convention Board Shopper Confidence (black), and Shapiro-Sudhof-Wilson/SF Fed Information Sentiment index (via 10/27) (inexperienced), all demeaned and normalized by normal deviation. NBER outlined peak-to-trough recession dates shaded grey. Supply: College of Michigan through FRED, Cummings-Tedeschi, Convention Board, SF Fed, NBER and creator’s calculations.

Addendum:

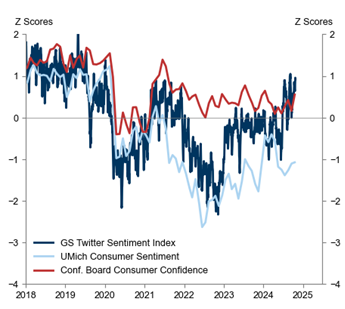

GS offers a comparability of UMichigan Sentiment index (unadjusted), Convention Board Confidence Index, and their in-house Twitter index.

Supply: Hatzius, et al. “USA: Job Openings Below Expectations in September; Consumer Confidence Well Above Expectations,” Goldman Sachs World Investor Analysis, October 29, 2024.