From Zerohedge

Given the lengthy lag between recessionary indicators and financial recession, it’s unsurprising economists gave up anticipating a recession. Nevertheless, whereas the recession has not occurred but, it doesn’t imply that it nonetheless can’t. We must always pay particular consideration to information traditionally correlated to financial progress.

To recap, listed here are the indications that the NBER makes use of to find out peaks and troughs, though not in “real time”.

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q1 advance launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (5/1/2024 launch), and writer’s calculations.

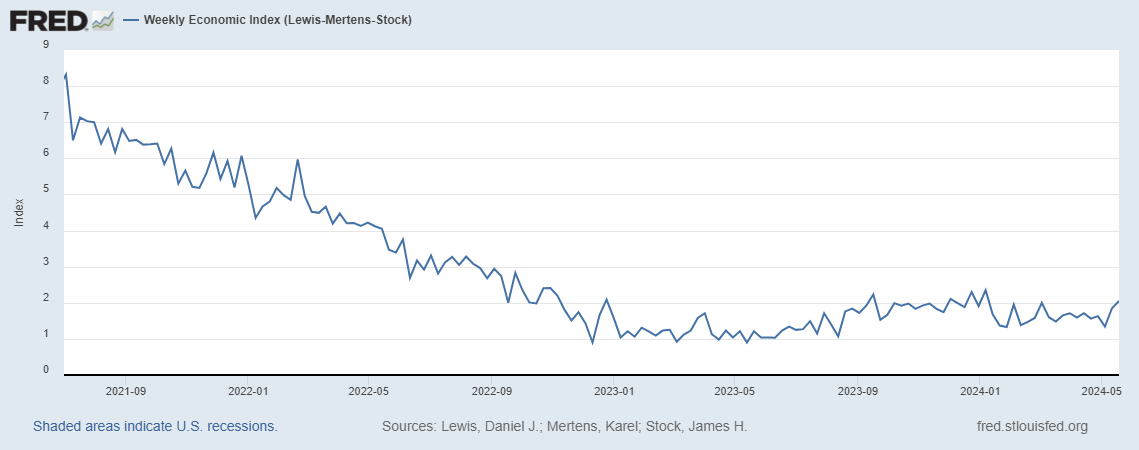

All people has their favourite indicator – Automobile Miles Traveled, gasoline consumption, progress of full time employees, and so forth. I’ll simply observe that the Lewis-Mertens-Inventory Weekly Financial Index exhibits 2.05% — simply at development if development is 2% — utilizing information launched by 18th of Could.

The Baumeister, Leiva-Leon, Sims Weekly Financial Circumstances Indicator registers -0.52% (i.e. about half a degree beneath development progress).

So the recession may nonetheless seem, perhaps six months from now, perhaps subsequent month. A easy plain vanilla time period unfold mannequin says Could is the best probability for a recession so it nonetheless may occur. Or not.