by Calculated Threat on 4/30/2024 01:00:00 PM

The Census Bureau launched the Residential Vacancies and Homeownership report for Q1 2024 at the moment.

The outcomes of this survey had been considerably distorted by the pandemic in 2020.

This report is often talked about by analysts and the media to trace family formation, the homeownership fee, and the house owner and rental emptiness charges. Nonetheless, there are critical questions in regards to the accuracy of this survey.

This survey may present the development, however I would not depend on absolutely the numbers. Analysts in all probability should not use the HVS to estimate the surplus vacant provide or family formation, or depend on the homeownership fee, besides as a information to the development.

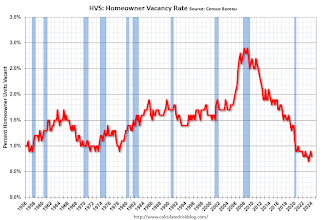

Nationwide emptiness charges within the first quarter 2024 had been 6.6 p.c for rental housing and 0.8 p.c for

house owner housing. The rental emptiness fee was not statistically completely different from the speed within the first quarter

2023 (6.4 p.c) and nearly the identical as the speed within the fourth quarter 2023 (6.6 p.c).The house owner emptiness fee of 0.8 p.c was nearly the identical as the speed within the first quarter 2023 (0.8

p.c) and never statistically completely different from the speed within the fourth quarter 2023 (0.9 p.c).

The homeownership fee of 65.6 p.c was not statistically completely different from the speed within the first quarter 2023

(66.0 p.c) and never statistically completely different from the speed within the fourth quarter 2023 (65.7 p.c).

emphasis added

Click on on graph for bigger picture.

The HVS homeownership fee decreased to 65.6% in Q1, from 65.7% in This autumn.

The ends in Q2 and Q3 2020 had been distorted by the pandemic and needs to be ignored.

The HVS house owner emptiness decreased to 0.8% in Q1 from 0.9% in This autumn.

The HVS house owner emptiness decreased to 0.8% in Q1 from 0.9% in This autumn.

As soon as once more – this in all probability reveals the final development, however I would not depend on absolutely the numbers.

The house owner emptiness fee declined sharply through the pandemic and contains properties which might be vacant and on the market (so this mirrors the low ranges of current dwelling stock).