Or, “who needs a stinkin’ independent central bank, non-Trump edition.”

May this text clarify why at 1:30 AM CST as I awaited information on the Russian Central Financial institution’s rate of interest determination… nothing occurred?

From Bloomberg yesterday (earlier than the choice):

ong feted because the savior of Russia’s economic system within the face of sanctions over the struggle in Ukraine, central financial institution Governor Elvira Nabiullina is more and more below assault from officers who say she’s now destroying it with file excessive rates of interest.

Nabiullina faces rising criticism inside the Russian political and enterprise elite forward of the financial institution’s last rate-setting assembly of the 12 months on Friday. Analysts forecast that policymakers could hike the important thing rate of interest to 23% from 21% now, and probably as excessive as 24% to curb persistent excessive inflation.

So, right here’s the coverage charge (crimson was what most individuals anticipated, a rise to 23%):

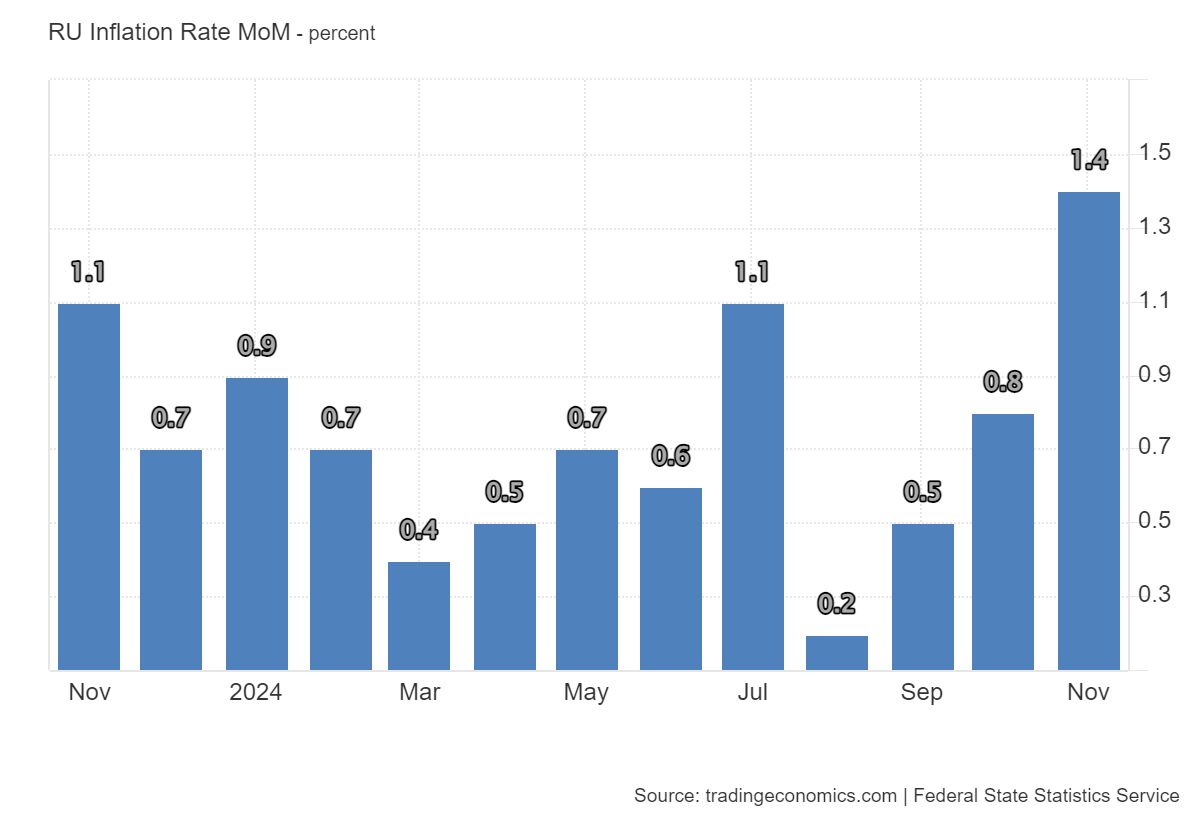

Right here’s November official inflation (m/m):

November inflation at 1.4% m/m is eighteen.2% at an annualized charge (y/y is 8.9%).

In the event you have been questioning what Romir’s FCMG indicated was inflation (see dialogue right here), you might be out of luck, because the publication of this sequence has “ceased”.

So, as Mark Sobel famous, Russia’s economic system seems to be lots weaker than the reported (official) statistics point out.