Me, interviewed with Buzz Kemper, on BadgerTalks, recorded on 8/6 (Episode 44).

A number of the numbers I used to be interested by:

NBER indicators normalized to 2024M03:

Determine 1 [corrected 8/13]: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (purple), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 launch), and creator’s calculations.

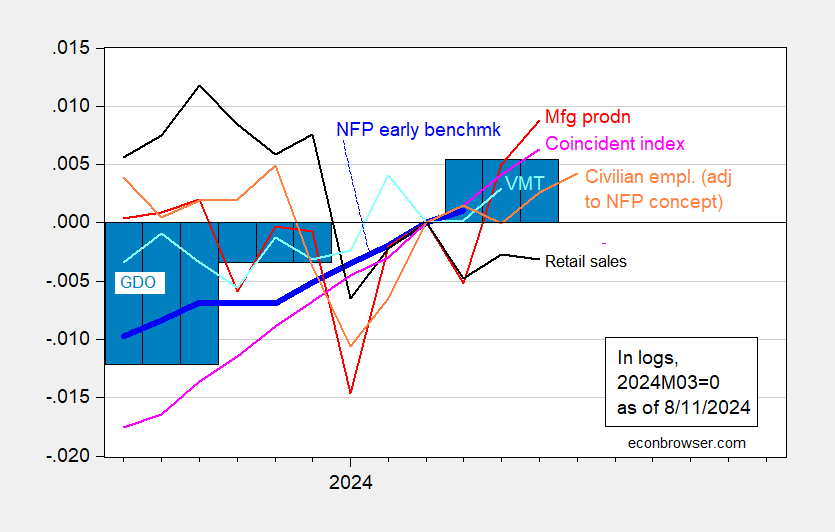

And various indicators normalized to the identical date:

Determine 2: Nonfarm Payroll (NFP) employment Philadelphia Fed early benchmark (daring blue), civilian employment adjusted to NFP idea (orange), manufacturing manufacturing (purple), retail gross sales (black), automobile miles traveled (gentle blue), and Coincident Index (gentle pink), GDO (blue bars), all log normalized to 2023M04=0. GDI utilized in calculating GDO for 2024Q2 estimated by predicting 2024Q2 internet working surplus utilizing GDP, lagged surplus, lagged differenced surplus, 2021Q1-2024Q1.Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 advance launch, Philadelphia Fed, and creator’s calculations.

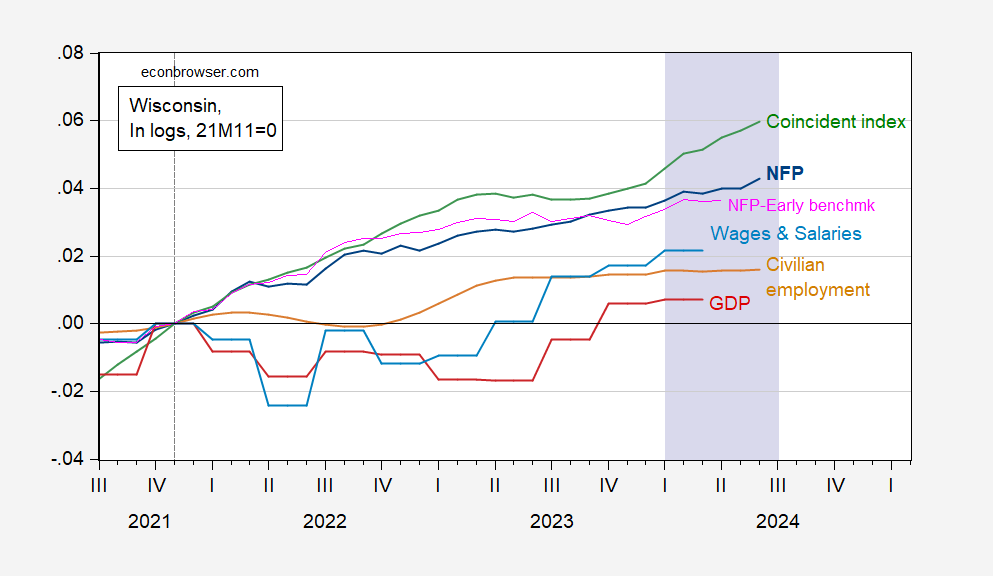

And for the Wisconsin financial system:

Determine 3: Wisconsin Nonfarm Payroll Employment (darkish blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), actual wages and salaries deflated by nationwide chained CPI (sky blue), GDP (purple), coincident index (inexperienced), all in logs 2021M11=0. Lilac shading denotes the 6 months after the WMC Winter survey. Supply: BLS, BEA, Philadelphia Fed [1], [2], and creator’s calculations.