From a paper by Michele Andreolli, Natalie S. Rickard, and Paolo Surico (introduced at NBER Summer season Institute Financial Economics periods):

Utilizing newly constructed time collection of consumption, costs and earnings in important and non-essential sectors, we doc three essential empirical regularities on post-WWII U.S. knowledge: (i) spending on non-essentials is extra delicate to the business-cycle than spending on necessities; (ii) earnings in non-essential sectors are extra cyclical than in important sectors; (iii) low-earners usually tend to work in non-essential industries. We develop and estimate a structural mannequin with non-homothetic preferences over two expenditure items, hand-to-mouth shoppers and heterogeneity in labour productiveness that’s per these findings. We use the mannequin to revisit the transmission of financial coverage and discover that the interplay of cyclical product demand composition and cyclical labour demand composition significantly amplifies business-cycle fluctuations.

Listed here are two key footage.

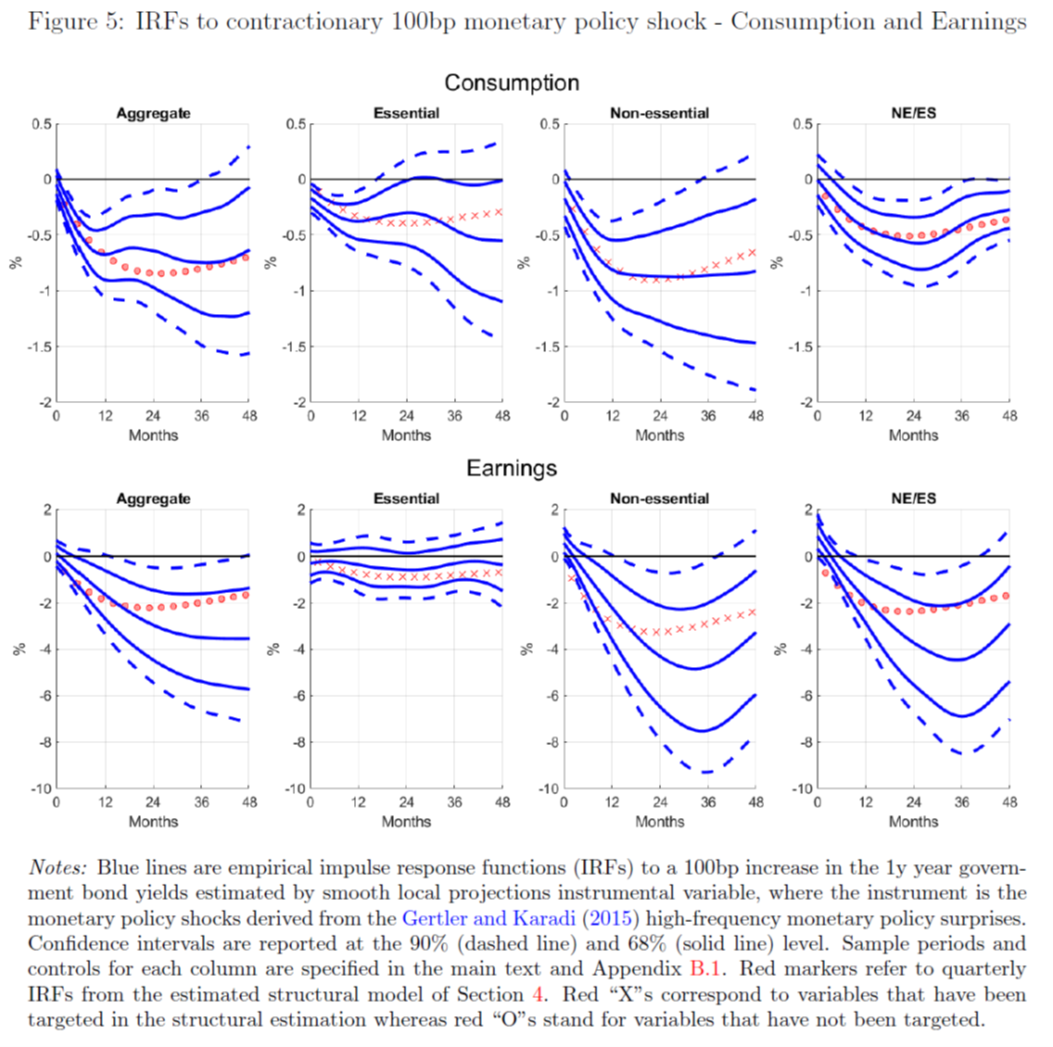

Supply: Andreolli et al (2024).

Notice that the non-essential share was lowering earlier than the pandemic (at the same time as consumption general was rising). Impulse responses features for a 100 bp financial shock present that disaggregation is vital in seeing what parts of consumption (and therefore the combination financial system) reply.

Supply: Andreolli et al (2024).

What’s a non-essential? The authors outline gadgets with demand elasticities higher than one (in absolute worth) as non-essential. Some apparent gadgets: meals away from residence, leisure, public transit.

The implication: Non-essentials reply rather more strongly the contractionary financial coverage than do necessities. Which means catching early the contractionary results of financial coverage requires taking a look at consumption at a disaggregate degree, and ideally at larger frequency than the standard month-to-month collection. What do these indicators appear to be?

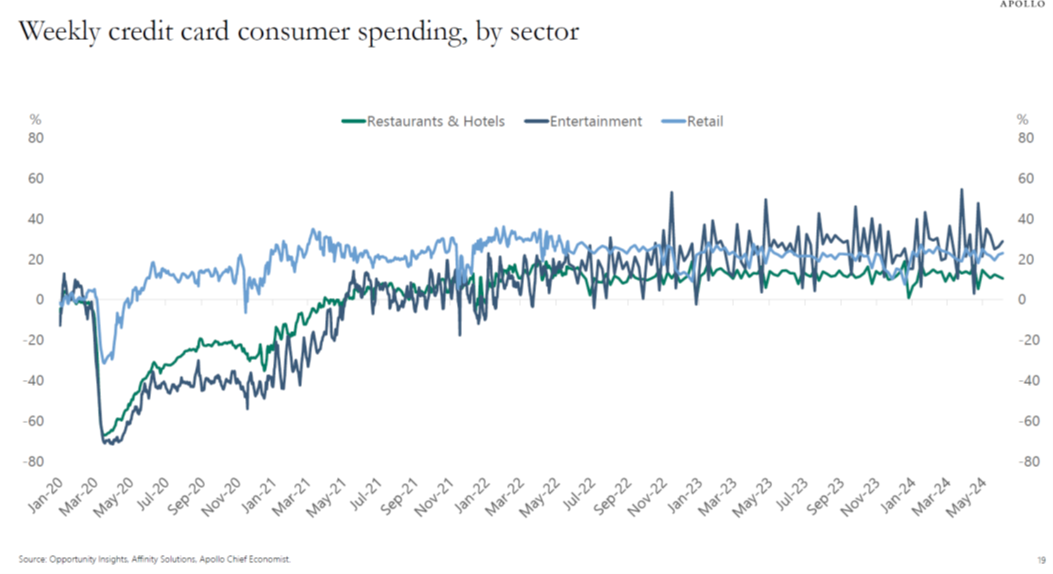

Right here’s bank card expenditure progress, courtesy of Torsten Slok et al. Eating places and inns (proxy for pleasure journey) and leisure are nonetheless rising, even holding in thoughts inflation.

Supply: Slok, Shah, Galwankar, “Daily and weekly indicators for the US economy,” Apollo, 17 August 2024.

From Slok’s communication right now, concerning these non-essential larger frequency indicators:

Wanting on the newest every day and weekly knowledge exhibits that … restaurant bookings are sturdy, air journey is robust, lodge occupancy charges are excessive, … and Broadway present attendance and field workplace grosses are sturdy. …The underside line is that there are not any indicators of a recession within the incoming knowledge…

That is contra Michaillat-Saez based mostly on month-to-month knowledge by July, mentioned on this put up, in addition to people on this listing.