The index got here in at +0.9% vs. +0.2% m/m.

I’ve inverted the greenback index in order that the trade fee and import worth ought to comove if there may be trade fee cross by.

Determine 1: Nominal greenback worth inverted (blue, left scale), and worth of all imported commodities excluding petroleum, n.s.a. (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve, BLS through FRED, NBER.

Word the uptick in import costs ex-petroleum (which reveals up in commodity import costs as properly). GS put up their estimate of the PCE deflator inflation by 1 bp (m/m) as a consequence.

Apparently, import costs from China have tracked the greenback/yuan.

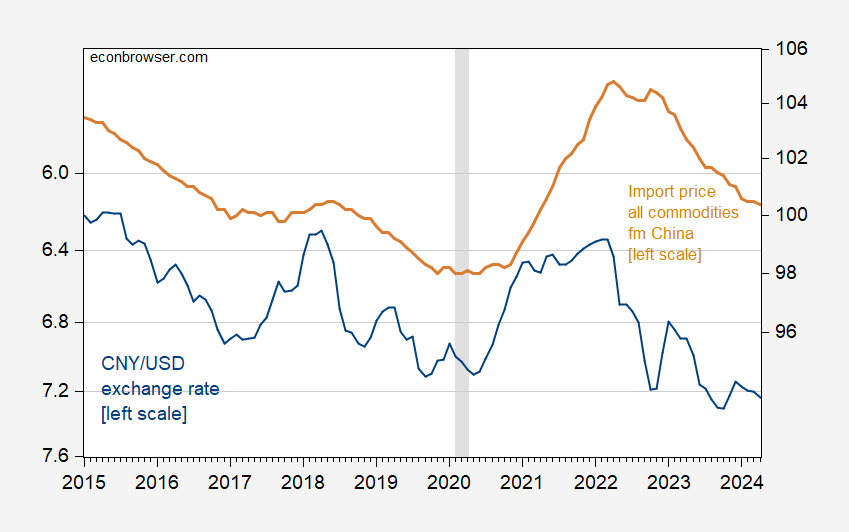

Determine 2: Nominal CNY/USD inverted (blue, left scale), and worth of all imported commodities from China, n.s.a. (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve, BLS through FRED, NBER.

Word that the import costs from China don’t incorporate the tariff prices (see right here).

Whereas the sequence seem to comove, it’s attention-grabbing that in actual fact trade fee cross by as a lot as may be measured is kind of low in the newest interval, from 2017M01-2024M04, on the order of 0.05. Utilizing the trade fee cross by coefficient of 0.3 obtained from a regression 2010M04-2017M01 (decrease than earlier 0.5 for 2005-2010), the import worth is about 5% increased than predicted (though the imprecision of the estimates locations the precise throughout the plus/minus one customary error band). This appears to counsel that US tariffs didn’t, on internet, push down the pre-tariff import worth into the US (i.e., basically full tariff cross by, as famous in U.S. ITC, 2023, web page 145).

Caveat: Regression on gross mixture magnitudes, so these are simply back-of-the envelope estimates.