From Saraiva/Bloomberg:

Goldman Sachs Group Inc. and Wells Fargo & Co. economists anticipate the federal government’s preliminary benchmark revisions on Wednesday to indicate payrolls progress within the 12 months by March was at the very least 600,000 weaker than at the moment estimated — about 50,000 a month.

Whereas JPMorgan Chase & Co. forecasters see a decline of about 360,000, Goldman Sachs signifies it might be as giant as one million.

There are a selection of caveats within the preliminary determine, however a downward revision to employment of greater than 501,000 can be the most important in 15 years and recommend the labor market has been cooling for longer — and maybe extra so — than initially thought.

The Philadelphia Fed has an early benchmark sequence which makes use of QCEW and different information to do early benchmarks. The sum-of-states on the CES or early benchmark sequence don’t essentially equal the nationwide CES NFP, however the Philadelphia Fed calculates the next:

Supply: Philadelphia Fed.

The Philadelphia Fed doesn’t report the time sequence for EB NFP. I do my advert hoc adjustment utilizing the ratio of CES sum of states to nationwide, to generate an pseudo-national CES early benchmark.

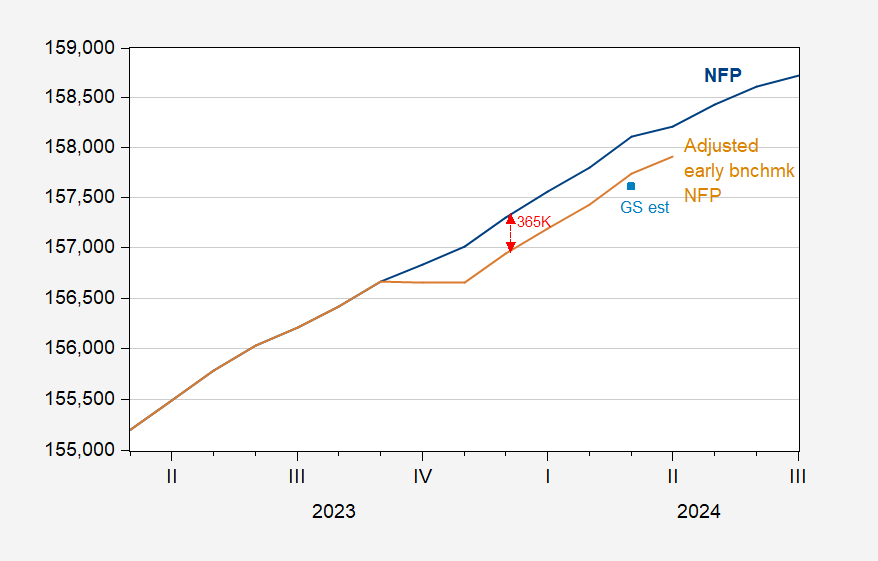

Determine 1: Degree of nonfarm payroll employment from CES (blue), from Philadelphia early benchmark (tan), Goldman Sachs estimate of preliminary revision (mild blue). Early benchmark calculated utilizing ratio of sum-of-states early benchmark to sum-of-states. Supply: BLS, Philadelphia Fed, and writer’s calculations.

The hole at December 2023 (the final accessible QCEW information) is 365K, and therefore March 2024 is 365K (the early benchmark makes use of the reported will increase in employment from January 2024-onwward).

The implied benchmark revision will “wedge in” the change in employment from the preliminary benchmark revision to the earlier last revision (i.e., March 2022 to March 2023), and use the reported modifications from April 2024 to by July 2024.