From the IMF (9/27/2024):

Determine 1: USD share of complete reserves as reported (mild blue), and USD share plus 60% of unallocated share (daring blue). Supply: IMF, COFER, and writer’s calculations.

Whereas this discount would possibly appears precipitous, it’s fascinating to notice the quicker shift was throughout the Trump administration. In any case, some context is beneficial.

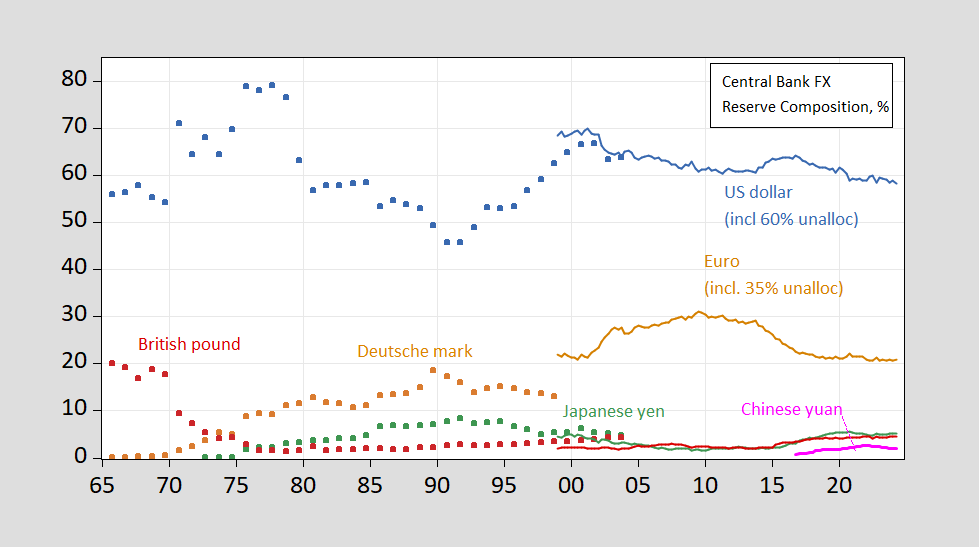

Determine 2: Share of overseas trade reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (crimson). For 1999 information onward, estimates based mostly on COFER information, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 10/1/2024, and writer’s estimates.

The lower from 2022Q3 might be accounted for by the lower within the worth of the US greenback (keep in mind the shares are calculated utilizing forex values evaluated utilizing market trade charges). So, a bit untimely to fret concerning the finish of the greenback’s reserve forex hegemony.

For extra on fx reserve holdings, from a central financial institution by central financial institution perspective, see Chinn et al. (2024), mentioned right here.