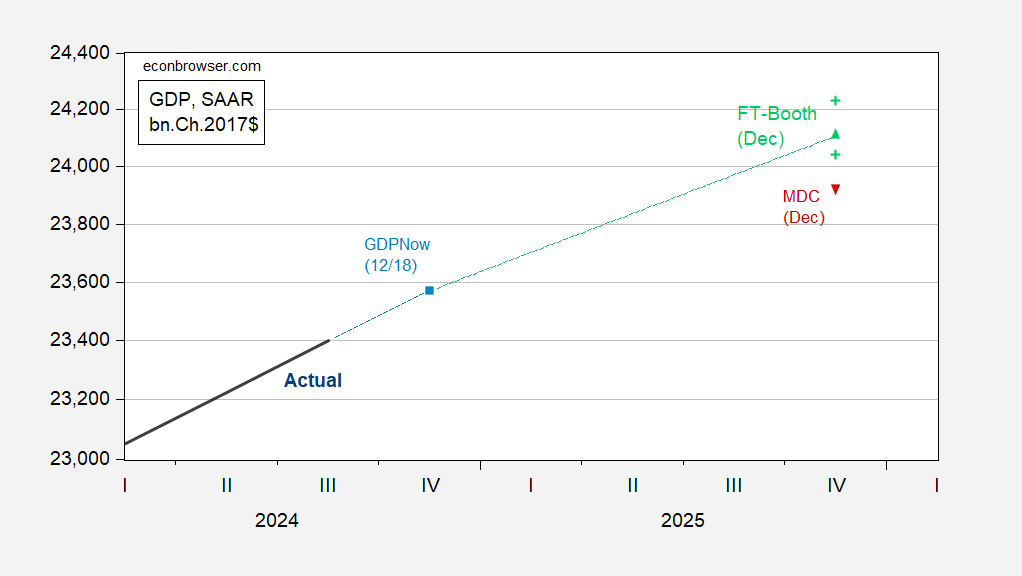

2025 this fall/this fall development median forecast is 2.3%. Right here’s a comparability in opposition to forecasts and nowcasts.

Determine 1: GDP, third launch (daring black), GDPNow of 12/18 (gentle blue sq.), Survey of Skilled Forecasters November median (brown), FT-Sales space median forecast of December (gentle inexperienced triangle). FT-Sales space ranges calculated cumulating this fall/this fall development off of GDPNow for This fall. Supply: BEA, Atlanta Fed, Philadelphia Fed, FT-Sales space survey, and creator’s calculations.

The modal response is for continued, albeit slowing, development.

Apparently, I’m one of many few forecasters that imagine that Trump will undergo with tariffs as acknowledged, and mass deportation (at the least some). Working from the McKibben-Hogan-Noland estimates for tariffs as acknowledged, I shave 0.5 ppts off of 2025 development of two% (November 2024 SPF median), to get 1.5%. Alternatively, one might use the Goldman-Sachs Republican sweep state of affairs, to shave off 0.55 ppts.

Determine 2 GDP, third launch (daring black), GDPNow of 12/18 (gentle blue sq.), FT-Sales space median forecast of December (gentle inexperienced triangle). FT-Sales space ranges calculated cumulating this fall/this fall development off of GDPNow for This fall, 10% trimmed excessive/low (gentle inexperienced +), Chinn’s forecast (inverted crimson triangle). Supply: BEA, Atlanta Fed, FT-Sales space survey, and creator’s calculations.

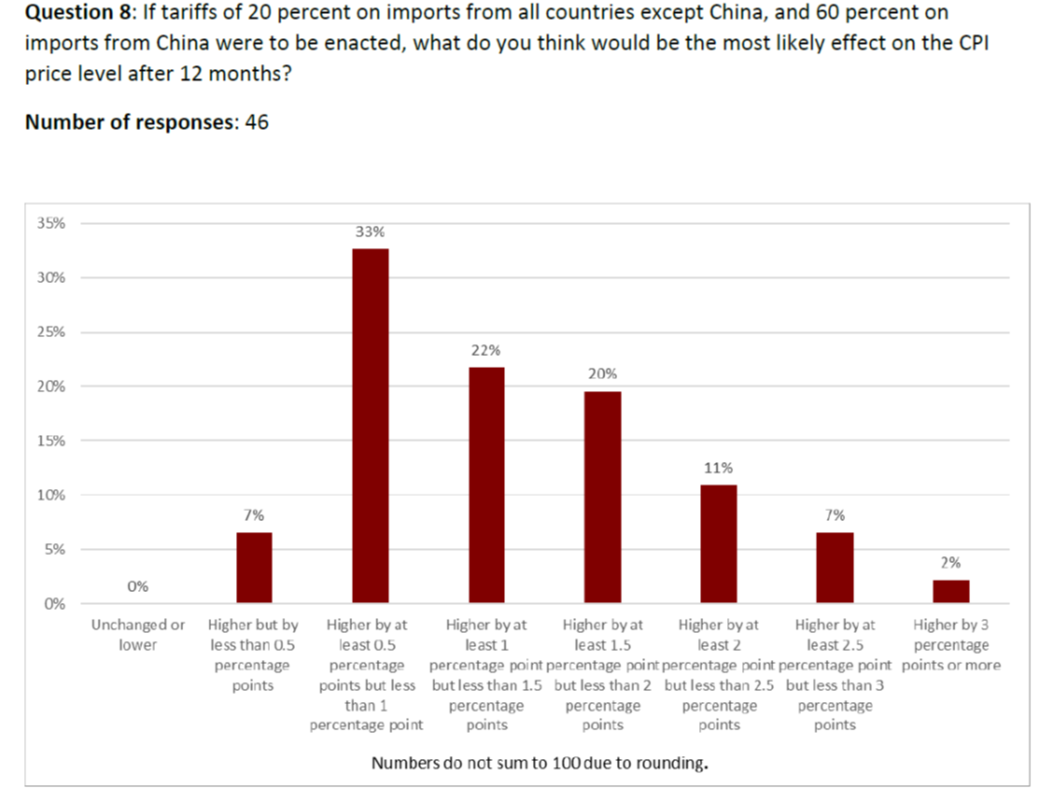

My interpretation is that many of the respondents don’t imagine that Mr. Trump will undergo with the tariffs he proposed earlier than the election (not to mention the elevated tariffs on Canada and Mexico).

Some attention-grabbing views on what the respondents assume the tariffs will do. On the cross via to CPI:

My response was the modal response.

Supply: FT-Sales space US Macroeconomists survey (December).

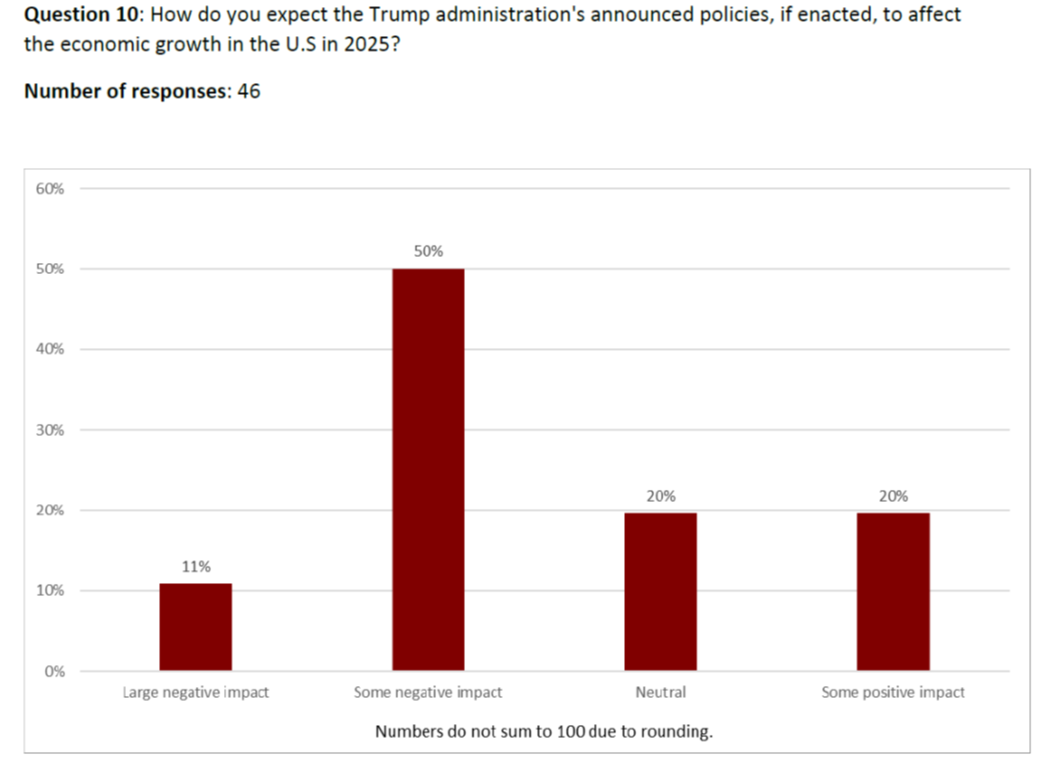

On the affect on development:

Supply: FT-Sales space US Macroeconomists survey (December).

On this query, my response of huge damaging affect was an outlier (though a majority of respondents — 61% — thought the affect can be damaging, in comparison with 20% that thought it will be constructive).

Notice that the McKibbin-Hogan-Noland estimates place the majority of the damaging affect of tariffs on GDP development in 2026.