From the Nationwide Corn Growers Affiliation:

U.S. soybeans and corn are prime targets for tariffs. As the highest two export commodities for our nation, collectively they account for about one-fourth of complete U.S. agricultural export worth. As such, a repeated tariff-based method to addressing commerce with China locations a goal on each U.S. soybeans and corn. Farmers and rural economies pay the worth because of this.

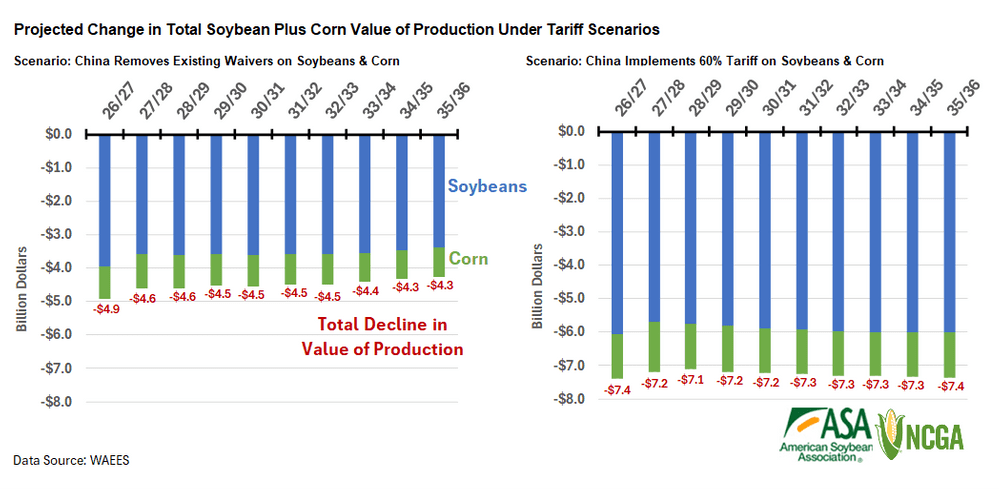

The report’s foremost conclusion (learn the entire examine for assumptions, mannequin, and so forth.):

Examine Findings

U.S. Soybean & Corn Exports Drop Whereas Brazil Good points Market Share

If China cancels its waiver and reverts to tariffs already on the books, U.S. soybean exports to China fall between 14 and 16 million metric tons yearly, a median decline of 51.8% from baseline ranges anticipated for these years. U.S. corn exports to China fall about 2.2 million metric tons yearly, a median decline of 84.3% from the baseline expectation. Though the export amount decline is way decrease for corn than soybeans, reflecting the smaller amount of corn exported to China, the relative change from the baseline amount is important for corn.

Whereas it’s doable to divert exports to different nations, there’s not sufficient demand from the remainder of the world to offset the main lack of soybean exports to China. On the similar time, Brazil and Argentina achieve world market share with elevated exports. The U.S. loses a mixed complete of two.3 to three.7 million metric tons of soybean plus corn exports yearly, whereas Brazil features a median of 4.6 million metric tons of soybean plus corn exports yearly.

Chinese language tariffs on soybeans and corn from the U.S. however not Brazil present incentive for Brazilian farmers to broaden manufacturing space much more quickly than baseline development. The enlargement is magnified as a result of some land space in Brazil can be utilized to develop a soybean and corn crop in the identical 12 months. Land transitioned into manufacturing space in Brazil will stay in manufacturing. The impression on U.S. soybean and corn farmers isn’t restricted to a short-term worth shock: This can be a long-lasting ramification that adjustments the worldwide provide construction.

A 60% retaliatory tariff degree intensifies the shock, leading to a lack of over 25 million metric tons of soybean exports to China and practically 90% of corn exports to China. On this state of affairs, the U.S. loses a mixed complete of two.9 to 4.6 million metric tons of soybean plus corn exports yearly, whereas Brazil features a median of 8.9 million metric tons of annual soybean plus corn exports over the projection timeline.

Right here’s their evaluation of the impression on US manufacturing in each situations.

In sum, farmers will see money revenue decline whereas prices enhance.

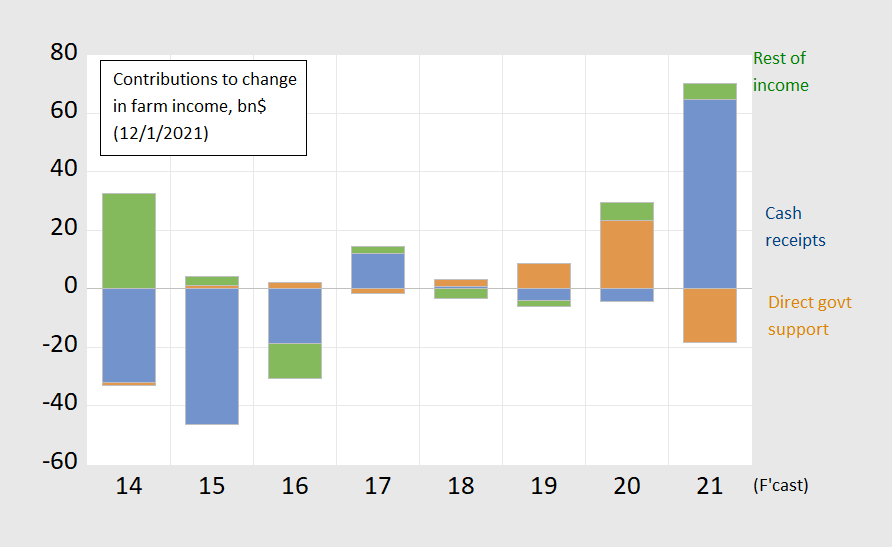

From a January 2022 submit, one can see how large a switch the Trump administration needed to implement with the intention to prop up farm revenue within the wake of that commerce conflict, and the way money revenue popped up in 2021. Therefore, regardless of decrease authorities assist, internet revenue is forecasted to be up.

Determine 1: Contributions to vary in farm revenue from money receipts from gross sales (blue bar), from direct authorities assist (brown bar), and from all different parts (inexperienced bar). Supply: USDA, information of 12/1/2021.

This time round, if Trump had been to impose 10-20% tariffs on every thing imported and 60% tariffs on Chinese language imports, then there’ll be much more individuals in line for bailouts than final time. In the event you imagine the farmers will likely be first in line subsequent spherical, then there’s a bridge I need to promote you.

See extra on the impression on the Midwest right here.

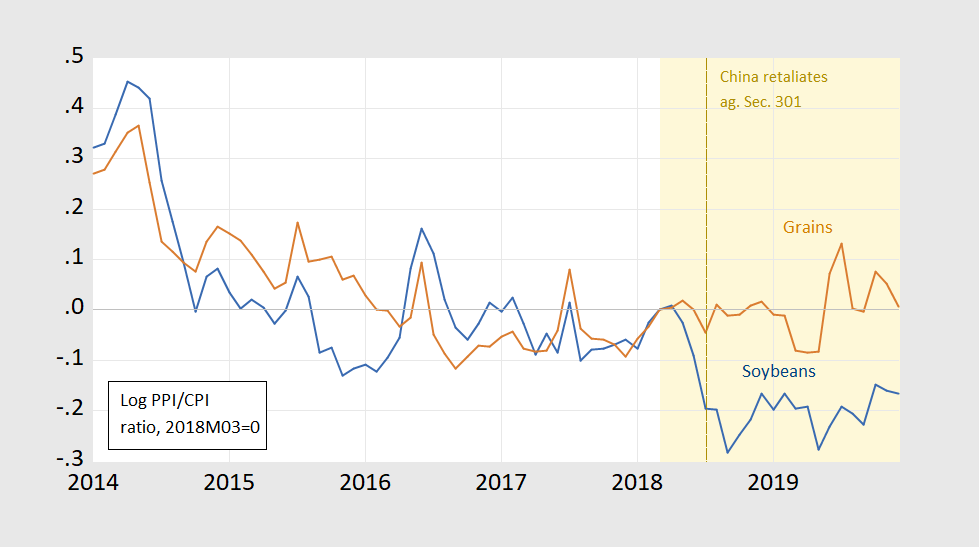

For a nostalgic journey down event-study lane, see this January 2020 submit, with this graph:

Determine 2: CPI deflated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. Orange shading denotes interval throughout which China Part 301 motion is introduced/carried out. Brown dashed line is when Chinese language tariffs on US soybeans goes into impact. Supply: BLS through FRED, creator’s calculations.