recession, inventory market decline, and housing market decline. From December nineteenth (Newport Seaside Unbiased):

- Financial Slowdown: The U.S. is prone to enter a recession, with customers anticipated to deplete their financial savings, resulting in just one doubtlessly constructive GDP quarter in 2024.

- Company Downsizing and Unemployment: Anticipated downsizing in companies could push unemployment charges up, although they’re anticipated to stay under 5%.

- Federal Reserve’s Coverage: The Fed would possibly enhance rates of interest by one other 25 foundation factors however will possible begin lowering charges in mid to late 2024, with cuts not exceeding 75 foundation factors until a worldwide disaster happens.

- Inventory Market and Bond Market: The inventory market is projected to expertise a 15% sell-off throughout the subsequent six months, adopted by a reasonable rally when charge cuts start. The bond market, after three consecutive down years, is predicted to see constructive progress in 2024.

- Housing Market: Housing costs would possibly decline by as much as 10%, however restricted stock ought to present some resilience.

- Industrial Actual Property: CRE values are anticipated to proceed declining, with multifamily properties doubtlessly underperforming after a decade of robust efficiency.

As I famous yesterday, median Survey of Skilled Forecasters is for no quarters of unfavourable progress, and nowcasts are for constructive progress in Q2.

Determine 1: GDP (daring black), Could SPF median (mild blue), GDPNow of 5/16 (blue sq.), New York Fed nowcast of 5/17 (inexperienced triangle), St. Louis Fed nowcast of 5/17 (tan sq.), all in bn.Ch.2017$, SAAR. Supply: BEA 2024Q1 advance, Philadelphia Fed, Atlanta Fed, NY Fed, St. Louis Fed through FRED, and writer’s calculations.

Therefore, the primary prediction appears unlikely to end up effectively.

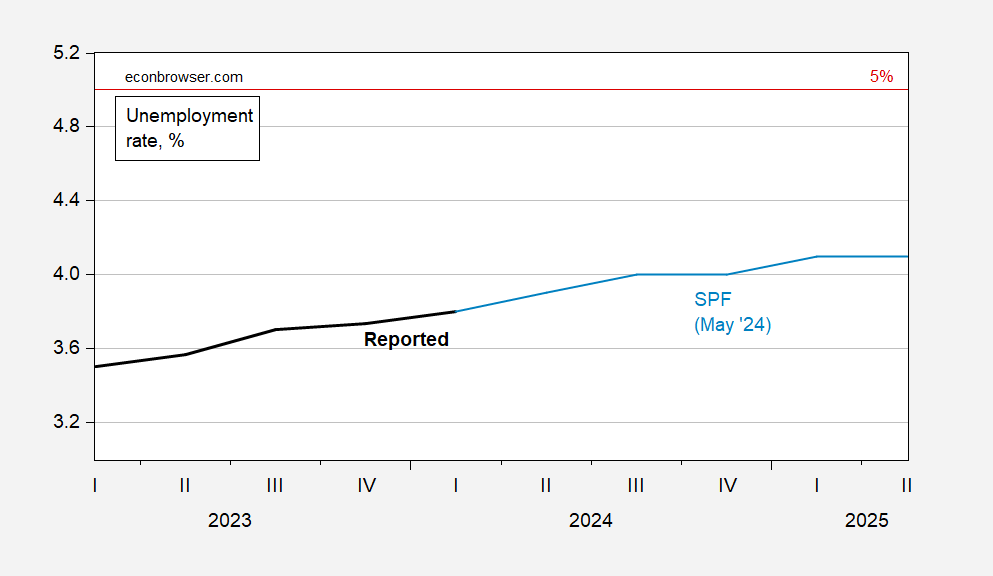

On unemployment, unemployment is predicted by the SPF to rise, however to far under 5%.

Determine 2: Unemployment charge (daring black), and Could SPF median forecast (mild blue), each in %. Supply: BLS, Philadelphia Fed.

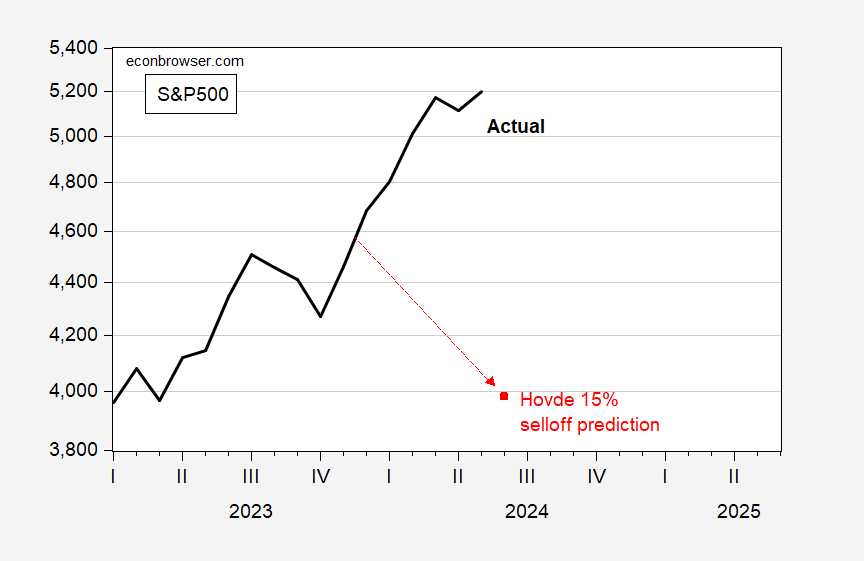

What concerning the 15% selloff? It’s unclear what the 15% is off of; I assume it’s the extent in December of 2023. Right here is plot of the S&P500 and what the S&P500 must be in June to match Hovde’s prediction.

Determine 3: S&P500 (daring black), and Hovde’s prediction (purple sq.). Could statement is thru sixteenth of Could. Supply: FRED, and writer’s calculations.

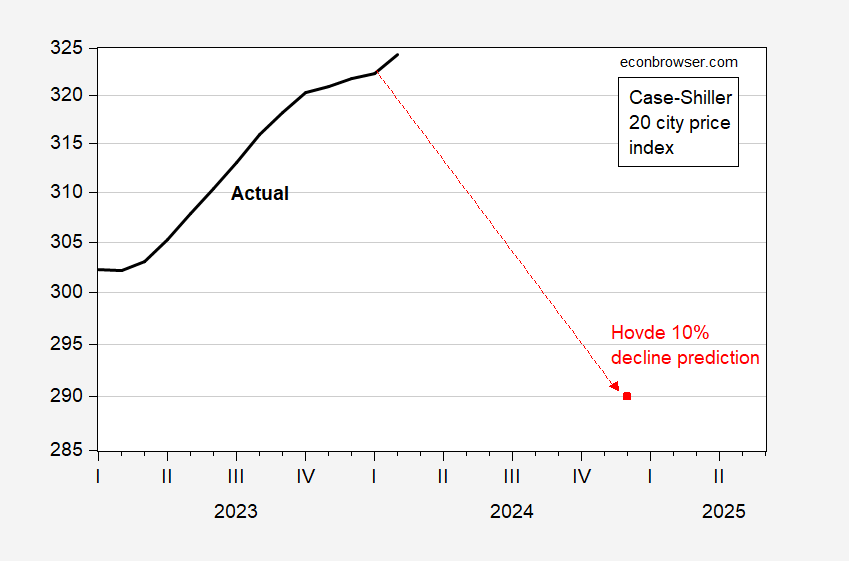

Lastly, what concerning the housing market? The ten% value decline is for 2024, so I assume the ten% decline is off December’s stage.

Determine 4: S&P Case Shiller 20 Metropolis home value index, s.a. (daring black), and Hovde’s prediction (purple sq.). Supply: FRED and writer’s calculations.