One of many final snapshots of the Biden financial system present actual consumption and private revenue rising, with consumption rising 0.6% (vs. consensus of 0.3%), and quicker than inflation. Listed below are some key indicators adopted by the NBER’s Enterprise Cycle Relationship Committee.

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 launch), and writer’s calculations.

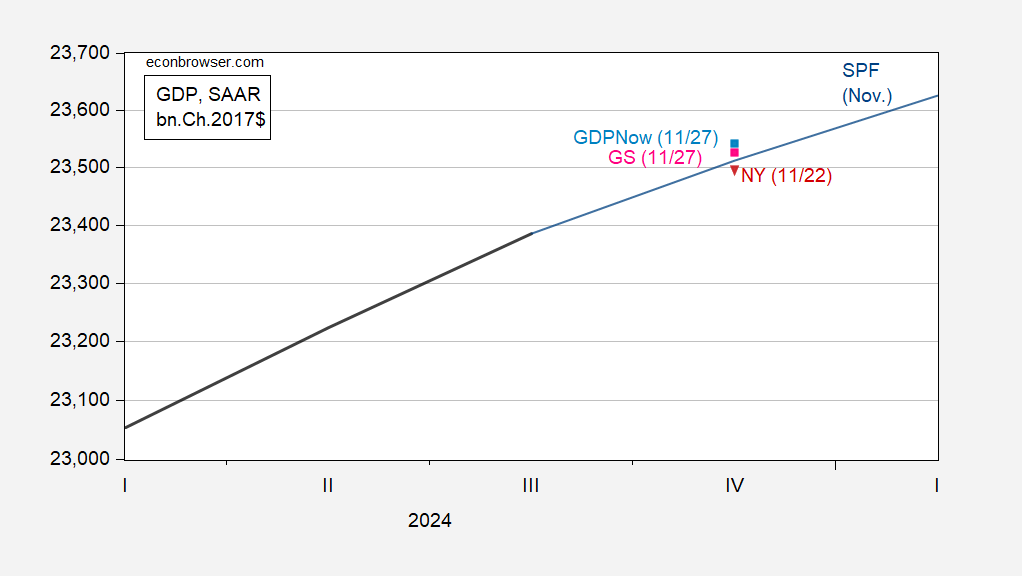

Nowcasts and monitoring estimates for This fall are largely unchanged. Right here’re some nowcasts in comparison with the SPF November median.

Determine 2: GDP (daring black), Survey of Skilled Forecasters November survey median (blue), GDPNow of 11/27 (gentle blue sq.), NY Fed nowcast of 11/22 (crimson triangle), and Goldman Sachs of 11/27 (pink sq.), all in bn.Ch.2017$ SAAR. Nowcast ranges of GDP calculated by iterating nowcast development fee on newest accessible GDP. Supply: BEA 2024Q3 2nd launch, Philadelphia Fed, NY Fed, Goldman Sachs and writer’s calculations.

Lastly, for prime frequency indicators, the Lewis-Mertens-Inventory Weekly Financial Index is at 1.8% for the week ending 11/23, whereas the Baumeister-Leon-Leiva-Sims WECI signifies -0.59%, which interprets into 1.41% if development development is 2%, down from an implied 3.42% at June’s finish.

In different phrases, there’s little proof of the recession that some observers have argued was in place from August. Moderately, the Biden administration has bequeathed the American public a remarkably robust financial system, with core PCE y/y inflation at 2.8%, and instantaneous PCE inflation at 2.4%.