(Or, ” I’ve in my hand fifty-seven circumstances of people…”) At 3:44 into this video, this Ms. DiMartino Sales space makes this assertion, claiming that is the explanation we haven’t seen a recession within the information pre-election.

She additional argues that left-leaning authorities statisticians artificially put employment numbers up (in order that the preliminary benchmark revision after which eventual benchmark revision could be downward). It is a testable speculation: it means that revisions could be downward when Democrats are searching for to carry presidential energy once more, and upward when Democrats are searching for to take the White Home. Does the information on preliminary benchmarks conform to his speculation? Quick reply: No.

Here’s a graph of preliminary benchmark revisions since 2007.

Determine 1: Preliminary benchmark revisions to nonfarm payroll employment, in ppts (blue). Pink arrows point out observations per speculation that authorities statisticians at BLS bias CES NFP numbers in favor Democrats. Supply: BLS, and particular person 12 months BLS preliminary benchmark revision releases.

Discover that of the final 5 elections, solely two conform to the DiMartino Sales space speculation. If the Deep (Statistical) State had been so pervasive, I’d’ve anticipated a greater batting common (and, wouldn’t it have been higher to have the preliminary benchmark be near reported, solely to have the benchmark (i.e., remaining) present the “correct” quantity.

See additionally my evaluation of comparable costs made by EJ Antoni.

Personally, I can’t keep in mind the final time the labor idea of worth got here up in a dialogue of Fisher best value indices…

For completeness’s sake, word that Ms. DiMartino Sales space assume job destruction within the non-public sector began in “early 2024”, though in a August 2024 interview, she indicated a recession begin to be backdated to October 2023.

Addendum:

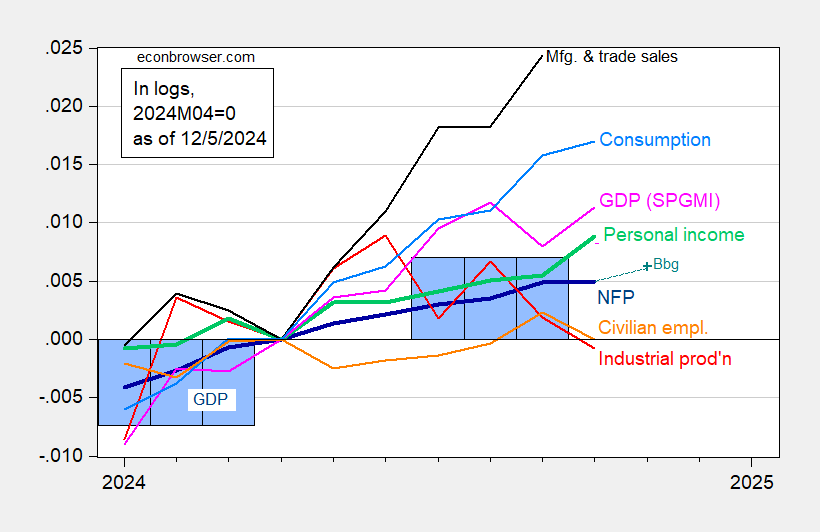

At 10:10 within the video, DiMartino Sales space locations the recession’s begin at April 2024. Taking that as the height, I’ve redrawn the NBER BCDC key variables normalized to 2024M04=0 (in logs).

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP Bloomberg consensus from 12/4 (teal +), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2024M04=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and creator’s calculations.

Word the employment information — even from nongovernmental supply ADP, as Macroduck notes — are trending up.

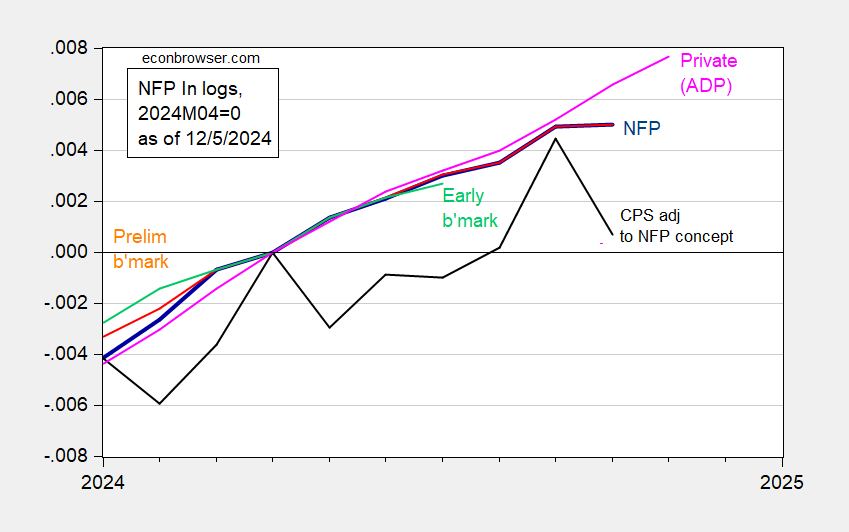

Determine 2: Nonfarm Payroll (NFP) employment from CES (blue), from implied preliminary benchmark (orange), Philadelphia Fed early benchmark (mild inexperienced), from CPS adjusted to NFP idea (black), non-public NFP from ADP-Stanford Digital Financial Lab (pink), all in logs 2024M04=0. Supply: BLS, ADP through FRED, BLS, Philadelphia Fed, and creator’s calculations.