Speaking concerning the greenback as an reserve forex subsequent week [2], and seen these fascinating tendencies.

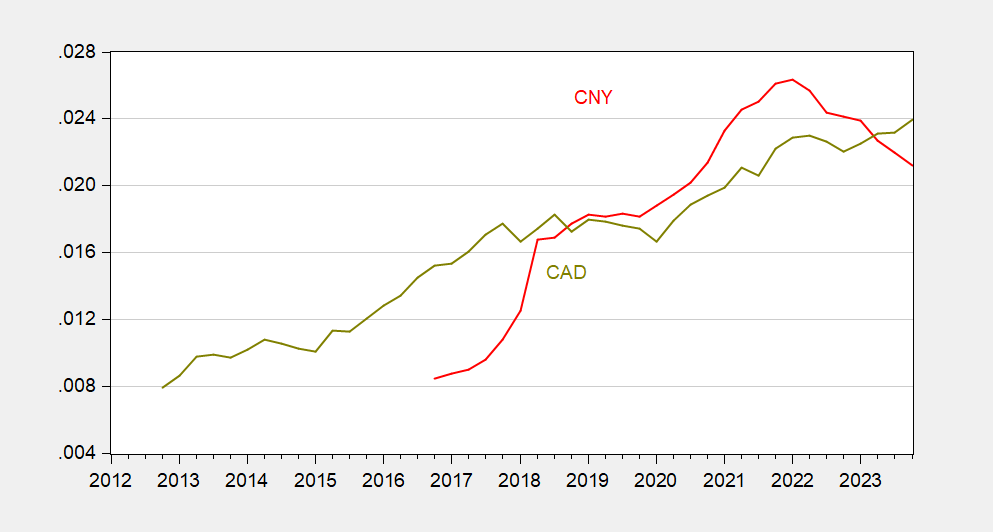

Determine 1: Share of FX turnover in CNY (pink sq.), in CAD (chartreuse triangle), in April. Normalized shares to 1.00. Supply: BIS Triennial Surveys.

The same sample holds for central financial institution reserve holdings as reported within the IMF’s COFER.

Determine 2: Share of central financial institution reserves in CNY (pink), in CAD (chartreuse). Supply: IMF.

Whereas there’s been some retrenchment in CNY holdings share since 2022, there’s a complication in decoding this development. Most if not all the discount may be poentially accounted for by CNY depreciation towards the USD (9% in log phrases, in contrast whereas the ratio has dropped about 5 ppts).

Nonetheless, I don’t assume the CNY will grow to be a significant worldwide forex anytime quickly, as mentioned right here (bear in mind, the euro accounts for 18.5 ppts of complete central financial institution fx reserves at year-end-2023).

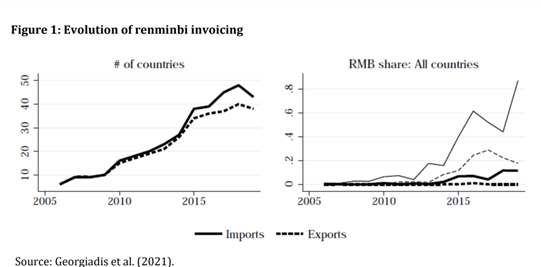

The realm the place the CNY has grow to be essential is in invoicing, not unsurprising given China’s dominant position in commerce. Ito and Chinn (2014) discusses this problem, however newer estimates are offered by Georgiadis (2021).

Notes: The left panel sows the variety of nations with information on renminbi invoicing. The fitting panel reveals the share of exports and imports invoiced in renminbi, with the median (thick strains) and the seventy fifth percentile (skinny strains).