I’m taking the WSJ’s phrase for it, from the article “Russia’s War Economy Shows New Cracks After the Ruble Plunges”.

The Russian economic system, surprisingly resilient by means of two-plus years of struggle and sanctions, has all of the sudden begun to point out critical strains.

The ruble is plunging. Inflation is hovering, and President Vladimir Putin informed the Russian individuals this week that there isn’t any cause to panic.

The catalyst for the change in financial fortunes was a choice by the Biden administration to ratchet up sanctions on Russia’s Gazprombank, the final main unsanctioned financial institution that Moscow makes use of to pay troopers and course of commerce transactions, in addition to greater than 50 different monetary establishments.

Whereas official statistics have definitely depicted a surprisingly resilient Russian economic system, there are positively questions relating to it’s true energy (remembering that “Potemkin village” is a time period originating from that nation). First the plunge within the ruble signifies the tradeoff that’s being made between defending the foreign money, staunching inflation and holding the economic system rising.

Bofit, per week in the past, highlighted the deceleration in y/y progress:

Russian GDP progress slowed considerably within the third quarter

Rosstat’s preliminary estimate places Russian GDP progress in July-September at 3.1 % y-o-y. GDP progress has slowed considerably this autumn. All core sectors have proven weaker progress in current months in comparison with the primary half of this 12 months.

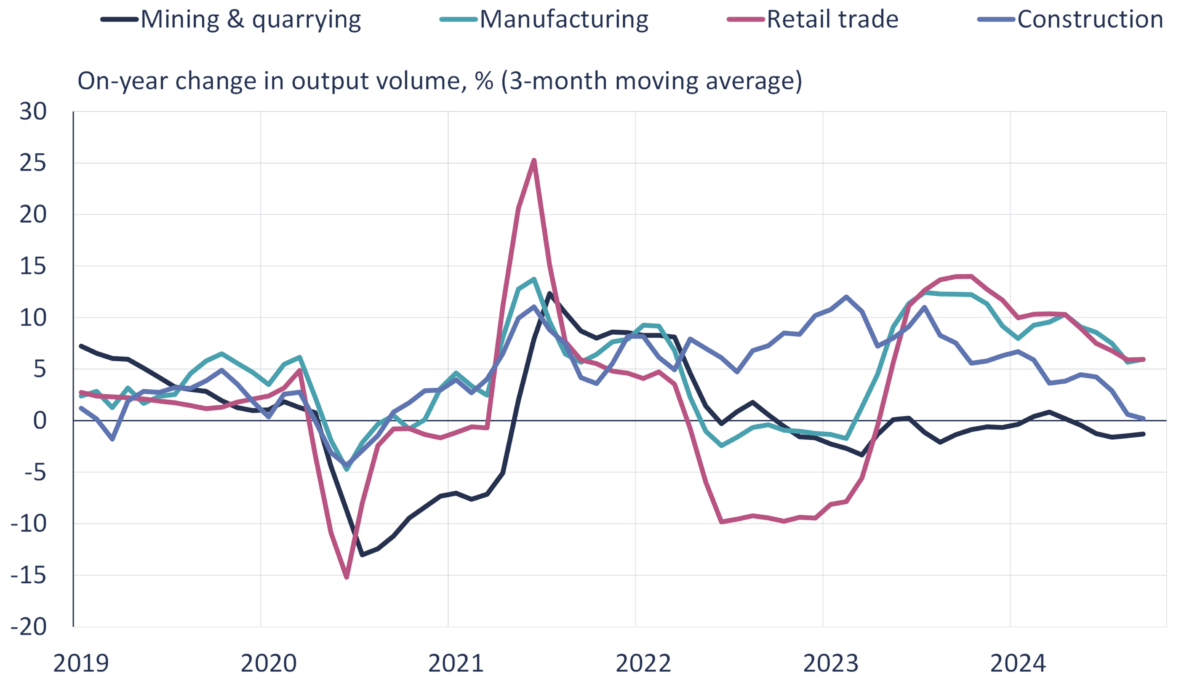

The slowdown in GDP progress has largely been pushed by pressures from the mining & quarrying and building sectors. On-year output of mineral extraction industries (contains oil & gasoline) has fallen in current months, whereas on-year progress in building is virtually zero. Agricultural output additionally contracted within the third quarter. GDP progress has nonetheless been supported by manufacturing and retail gross sales, however progress has slowed additionally in these branches. Manufacturing progress, in flip, has been pushed primarily by industries associated to struggle.

Right here’s their graph, utilizing official statistics:

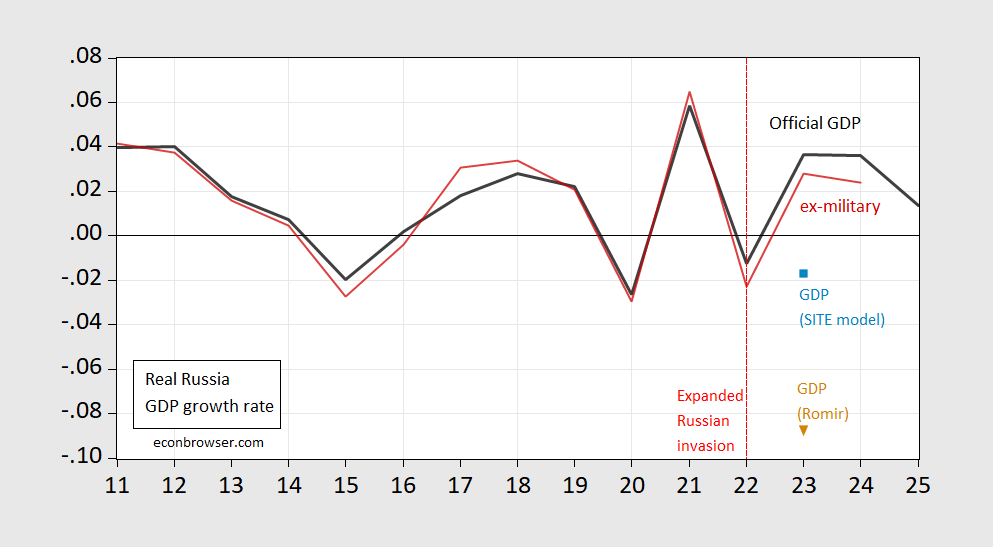

Lastly, let’s take into consideration the plausibility of Russian statistics, and in addition what GDP measures. First, evaluate official GDP to official GDP ex-military spending (as estimated by SIPRI):

Determine 1: Official Russian GDP progress (black), official GDP ex-military spending progress (purple), Russian GDP utilizing SITE oil-based mannequin (mild blue sq.), official GDP utilizing Romir value index as deflator (tan inverted triangle). GDP ex-military spending calculated utilizing nominal values, deflating by general GDP deflator. Supply: IMF October 2024 WEO, SIPRI database, SIPRI, SITE (Determine 26), and creator’s calculations.

The sturdy progress seems much less sturdy when deducting outright army expenditures (observe that capital prices related to protection spending, together with different inside safety operations, wouldn’t be included in SIPRI’s estimates of army expenditures).

As well as, the Stockholm Institute of Transition Economies, in it’s current report on the Russian economy, supplies a number of different estimates of Russian GDP progress. I present two estimates: (i) one based mostly on a easy econometric mannequin linking oil costs to Russian GDP, and (ii) nominal GDP deflated by the Romir value index (see this publish).