That’s the title of a GJ Collins article on SeekingAlpha immediately — however it’s not what you assume it means…

The decision of the inverted 10-year and 3-month yield curve normally alerts a recession down vary.

Nicely if inversions precede recessions, than this sort of is sensible, though the query is then how a lot do dis-inversions precede recessions (or do they happen in the course of the recession).

To judge this formally, contemplate the 10yr-3mo time period unfold from 1960 onward.

Determine 1: 10yr-3mo Treasury time period unfold, % (blue). NBER outlined peak-to-trough recession dates shaded grey. Inexperienced arrows point out occasions per disinversion sign. Purple arrows point out occasions not constant. Supply: Treasury through FRED, NBER, and creator’s calculations.

I create a disinversion dummy taking up a worth of 1 within the first month the unfold is constructive after being within the adverse vary. Therefore, will increase within the unfold when no inversion has taken place don’t register a 1 worth for the dummy.

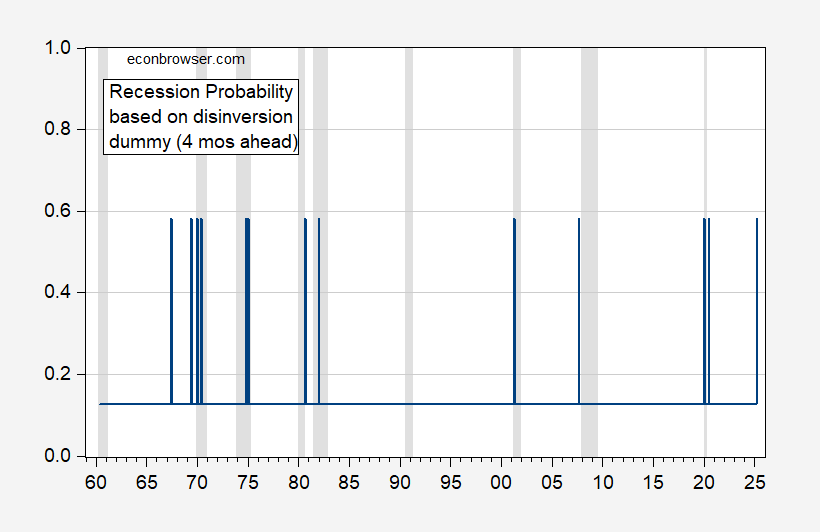

The maximal pseudo-R2 is obtained for a ramification of 4 months, over the 1960-2024 interval (assuming no recession happened in 2024) is about 0.023. Utilizing this specification (a probit on a binary dummy) yields these recession chances.

Determine 2: Estimated recession chances utilizing 4 month lead of recession on disinversion dummy (blue). NBER outlined peak-to-trough recession dates shaded grey. Supply: NBER, and creator’s calculations.

The 1960-61 and 1990-91 recessions are missed (though a 10yr-2yr disinversion may catch the latter), whereas a recession is predicted for April 2025. In fact, if the inversion didn’t predict the 2024 recession, is there purpose to imagine the disinversion will predict properly?