Locking up the butter in Russia (CNN). Official inflation in October was 0.8% m/m (annualize that and it’s about 10%. That’s the official inflation charge. The ex put up charge is round 11% then.

Taking the CBR’s anticipated inflation charge of 13.4% at face worth, this means a 7.6% ex ante actual charge. With the coverage charge anticipated to rise to 23% at December’s assembly, this could indicate 9.6% ex ante actual charges assuming anticipated inflation stays fixed.

There may be an attention-grabbing query of whether or not we are able to take the CPI numbers popping out of the Rosstat at face worth. A latest report by the Stockholm Institute of Transition Economics observes:

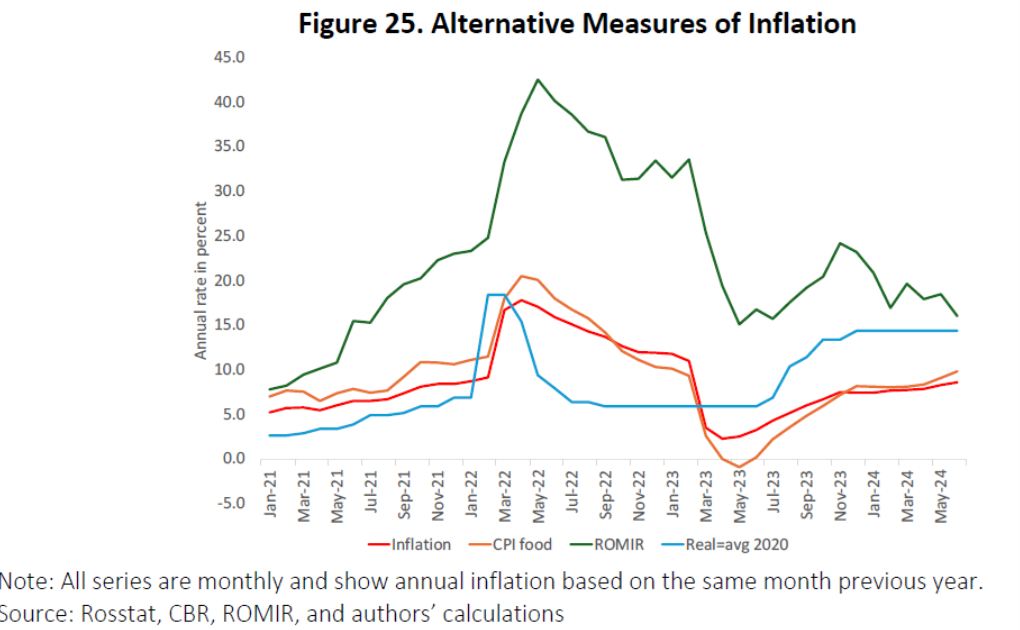

…the credibility of the official inflation numbers put out by Rosstat. Determine 25 reveals some different measures of inflation that recommend that the official numbers could critically understate the inflation households face. The primary different measure is the fastmoving shopper items (FMCG) index produced by the unbiased Russian public opinion monitoring service ROMIR.25 The FMCG principally contains meals and cosmetics and ROMIR estimates that the share of FMCG in complete family expenditures is round 50 p.c. Their index produces constantly larger inflation charges than each complete CPI and the meals CPI index produced by Rosstat. In Could of 2022 their inflation measure peaked at over 40 p.c at an annual charge. It has since come down considerably however has remained at round twice the charges printed by Rosstat. In June 2024, which is the most recent month at the moment obtainable, the ROMIR inflation charge is at 16 p.c versus 8-10 p.c for the CPI and meals CPI inflation by Rosstat. In distinction to ROMIR, Rosstat historically considers the share of meals within the Russian CPI basket to be 38 p.c, which Milov (2022) argues is simply too low and results in an underestimation of inflation. Secondly, Rosstat observes costs for items which shoppers do in reality purchase. It’s doubtless that many Russian households have began to purchase cheaper substitute items as a result of sanctions and finances constraints and that such substitution results is not going to be mirrored in CPI.

Right here’s Determine 25 from that research.

Supply: Stockholm Institute for Transition Economics.

Determine 25 additionally offers an implied inflation charge if CBR was making an attempt to carry the true coverage charge at 2020 ranges. Utilizing that logic to assemble another anticipated inflation sequence is smart if the pure charge (r*) doesn’t change. Nonetheless, my guess is that given the massive fiscal stimulus and lack of labor inventory, r* most likely has modified, so the blue line is especially questionable in my thoughts.

In any case, a 21% coverage charge mixed with both 13.4% or 16% (10% official CPI plus 6 share factors for mismeasurement) nonetheless yields a 5-7.6% actual charge — fairly excessive.