In step with expansionary fiscal coverage plus tariffs hitting a non-passive Fed response operate.

Determine 1: TIPS fixed maturity 5 12 months yield (blue), 5 12 months breakeven (Treasury minus TIPS) (crimson), each in %. Crimson dashed line at election. Supply: Treasury through FRED.

The breakeven rises by 11 bps since election day.

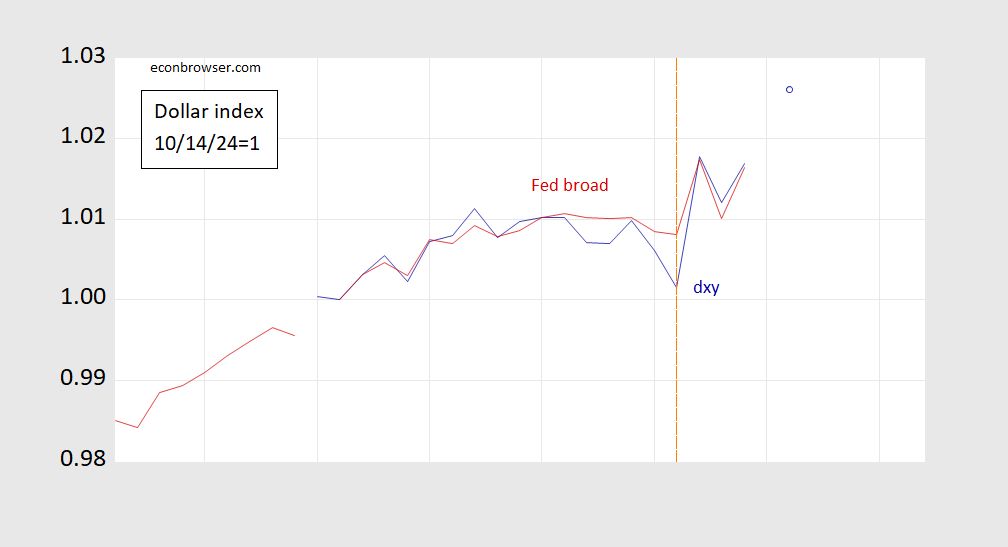

Determine 2: DXY greenback index (blue), Fed broad greenback index (tan), each normalized to 10/14/2024=1.. Crimson dashed line at election. Supply: Fed through FRED, Tradingeconomics.com.

The greenback index is up 2.4% since election day.