The Bureau of Financial Evaluation introduced immediately that seasonally adjusted U.S. actual GDP grew at a 2.8% annual fee within the third quarter. That’s near the long-run historic common of three.1%. With inflation coming down, I believe we now can declare that the Fed has achieved the admirable however troublesome goal of a “soft landing” — bringing inflation down with out tipping the U.S. into recession.

Quarterly actual GDP development at an annual fee, 1947:Q2-2024:Q3, with the historic common (3.1%) in blue. Calculated as 400 occasions the distinction within the pure log of actual GDP from the earlier quarter.

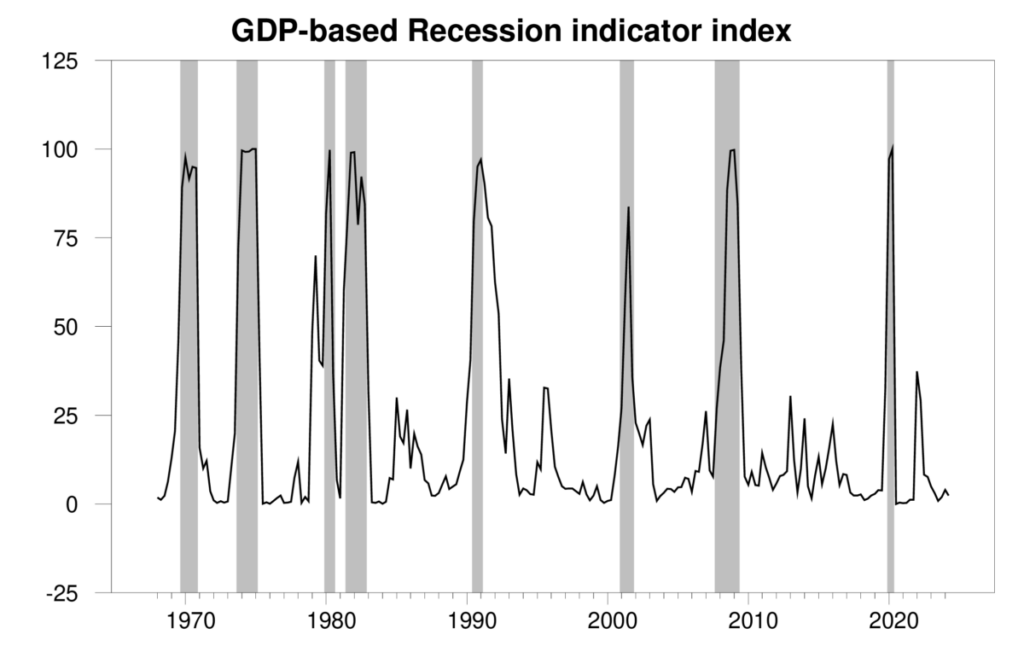

The brand new numbers put the Econbrowser recession indicator index at 2.4%. That’s fairly a low quantity, and indicators an unambiguous continuation of the financial growth that started in 2020:Q3.

GDP-based recession indicator index. The plotted worth for every date is predicated solely on the GDP numbers that had been publicly out there as of 1 quarter after the indicated date, with 2024:Q2 the final date proven on the graph. Shaded areas characterize the NBER’s dates for recessions, which dates weren’t utilized in any approach in developing the index.

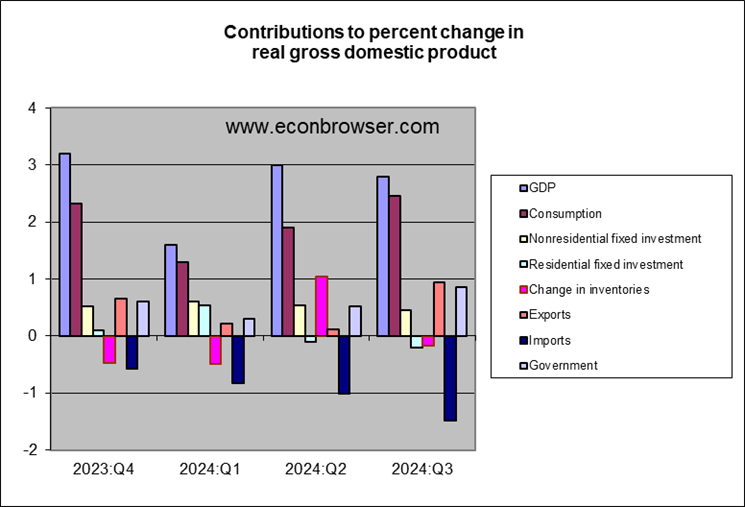

GDP development was led by robust spending by shoppers, who appear to be regaining confidence as employment development continues robust. Third-quarter GDP was additionally boosted by an enormous enhance in authorities spending related to army help to Israel and Ukraine. A surge in imports, that are subtracted from GDP, held GDP development again. Slower new residence development additionally subtracted from GDP development, however to not the diploma that we’d see if the Fed had engineered an enormous housing crunch.

Markets additionally breathed a sigh of aid this week that the army battle within the Center East doesn’t look (for now) as if it’s going to result in an enormous disruption in oil manufacturing or delivery. All this is sufficient to deliver a smile again to the face of our Little Econ Watcher.

For now.