by Calculated Threat on 9/12/2024 12:29:00 PM

The Federal Reserve launched the Q2 2024 Circulation of Funds report at this time: Monetary Accounts of the USA.

The online price of households and nonprofits rose to $163.8 trillion through the second quarter of 2024. The worth of instantly and not directly held company equities elevated $0.7 trillion and the worth of actual property elevated $1.8 trillion.

…

Family debt elevated 3.2 % at an annual price within the second quarter of 2024. Shopper credit score grew at an annual price of 1.6 %, whereas mortgage debt (excluding charge-offs) grew at an annual price of three %.

Click on on graph for bigger picture.

The primary graph exhibits Households and Nonprofit web price as a % of GDP.

Web price elevated $2.8 trillion in Q2 to an all-time excessive. As a % of GDP, web price elevated in Q2, however is under the height in 2021.

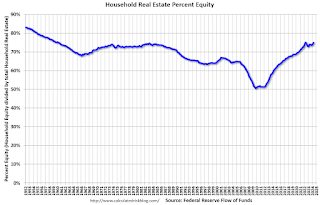

Family % fairness (as measured by the Fed) collapsed when home costs fell sharply in 2007 and 2008.

In Q2 2024, family % fairness (of family actual property) was at 74.9% – up from 74.2% in Q1, 2024. That is near the very best % fairness because the Sixties.

Observe: This contains households with no mortgage debt.

Mortgage debt elevated by $98 billion in Q2.

Mortgage debt is up $2.34 trillion from the height through the housing bubble, however, as a % of GDP is at 45.9% – down from Q1 – and down from a peak of 73.3% of GDP through the housing bust.

The worth of actual property, as a % of GDP, elevated in Q2 – however is under the height in Q2 2022, and is nicely above the common of the final 30 years.