From the paper summary:

We examine the extent to which the perceived value of dropping the exorbitant privilege the US holds in world secure asset markets sustains the security of its public debt. Our findings point out that the lack of this particular standing within the occasion of a default considerably augments the debt capability for the US. Debt ranges could be as much as 30% decrease if the US didn’t have this particular standing. Most of this additional debt capability arises from the lack of the comfort yield on US Treasuries, which makes debt costlier following its loss and gives robust incentives to repay debt.

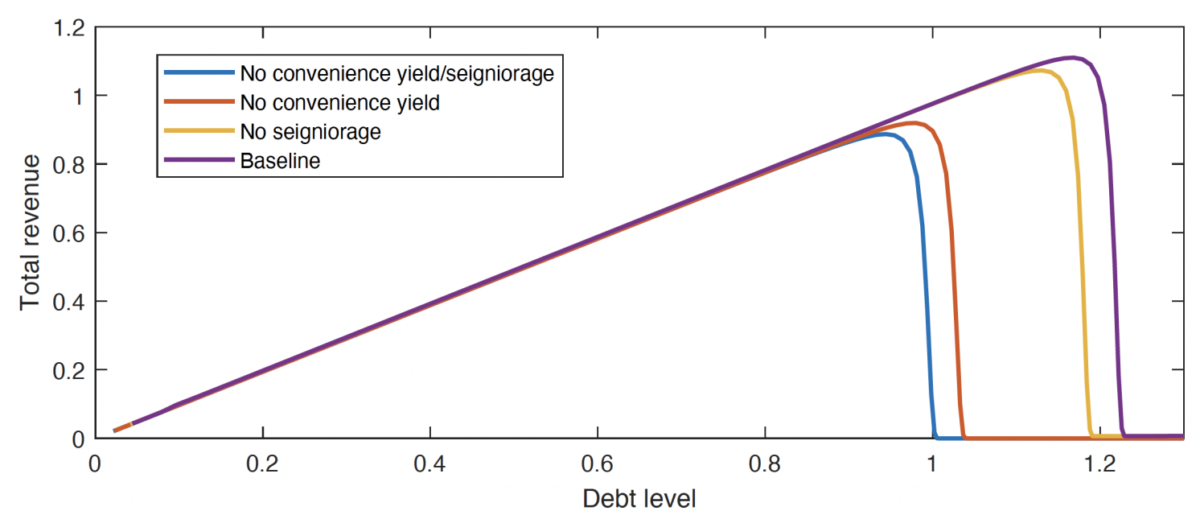

Two graphs are key (taken from the VoxEU put up on this paper):

From the conclusion:

. The particular standing of the US will increase the maximal debt that may be sustained in equilibrium by roughly 22% of GDP. Nearly all of this elevated debt capability arises from the comfort channel: an economic system the place US debt doesn’t supply a non-pecuniary profit to holders incorporates a most debt degree 18% decrease, whereas an economic system with out overseas seigniorage incorporates a most debt that’s solely 3% decrease.