NFP +142 vs. consensus +166. Employment has virtually absolutely slowed (preserving in thoughts that is the preliminary launch). What does this appear to be?

Determine 1: Nonfarm payroll (NFP) employment from CES (blue), Bloomberg consensus assuming no revisions to earlier months (gentle blue), NFP early benchmark (tan), QCEW complete coated employment seasonally adjusted by writer utilizing X-13 (crimson), civilian employment adjusted to NFP idea (inexperienced), all in logs, relative to 2023M03. Supply: BLS, Bloomberg, Philadelphia Fed, and writer’s calculations.

With the earlier months of revisions, the “miss” on consensus is 108K, not 24K. Then again, the CPS model of NFP employment (individuals, not jobs) was +178 (vs. +142K from CES). Given the excessive variability in the-CPS-based collection, I wouldn’t take an excessive amount of solace from this.

What in regards to the impression of the preliminary benchmark? As I’ve famous earlier than, this has an enormous — maybe too huge — impression on the extent of measured employment.

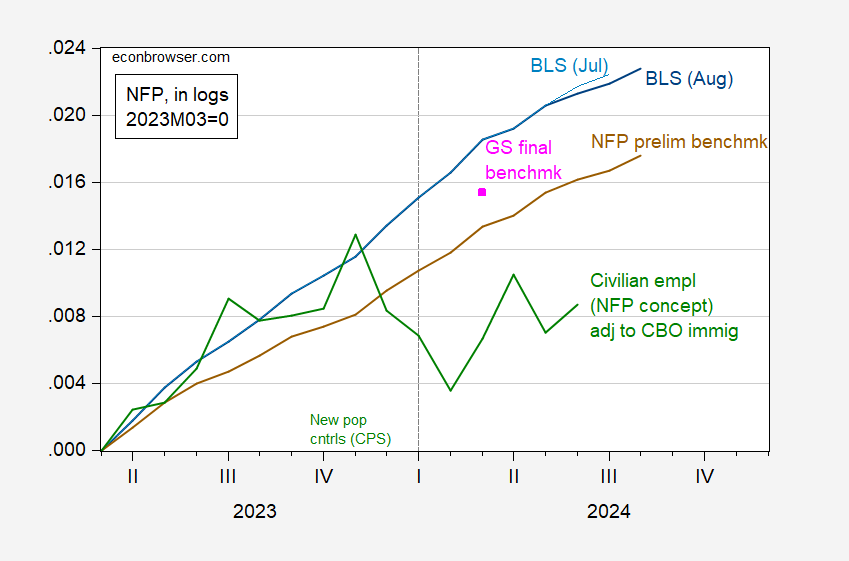

Determine 2: Nonfarm payroll (NFP) employment from August CES (blue), from July CES (gentle blue), Bloomberg consensus assuming no revisions to earlier months (gentle blue), implied NFP preliminary benchmark (brown), civilian employment adjusted to NFP idea, adjusted by writer utilizing ratio of CBO immigration degree implied civilian employment (inexperienced), Goldman Sachs estimate of NFP closing benchmarked employment (pink sq.), all in logs, relative to 2023M03. Supply: BLS, Bloomberg, Philadelphia Fed, and writer’s calculations.

I’ve adjusted the BLS’s different NFP employment collection by the ratio of my adjustment to civilian employment accounting for the upper employment estimated by CBO (see dialogue right here), besides I’ve utilized to June 2024 the changes (2024 is the fiscal yr for reporting immigration), as an alternative of to June 2023.

By these counts, employment continues to be rising on a year-to-year foundation, even the CPS primarily based collection. Because the graphs are proven on log scales, then it’s clear that the collection are decelerating in development, because the Fed has aimed for.