Headline and core shock on the draw back: m/m 0.2% vs. 0.3% consensus, and 0.0% vs 0.1% consensus, respectively. Extra curiously, Cleveland Fed core CPI nowcast for Could m/m was 0.30%, precise was 0.16%.

First, a comparability of various measures of headline – y/y, instantaneous, m/m:

Determine 1: 12 months-on-12 months CPI inflation (daring black), instantaneous inflation (T=12, a=4) per Eeckhout (2023) for CPI (tan), month-on-month (inexperienced), Supply: BLS by way of FRED, and creator’s calculations.

Instantaneous inflation declines to 1.8%, which is beneath the two.45% CPI inflation according to a 2% PCE inflation.

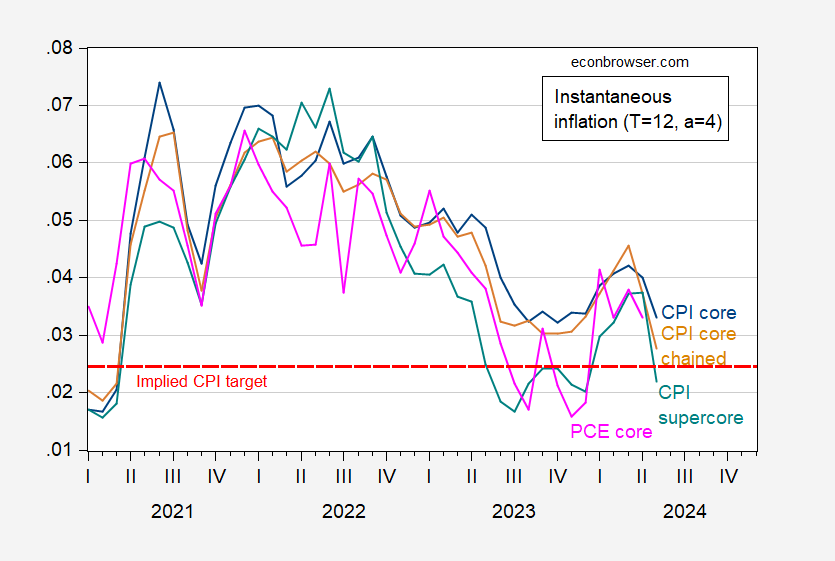

What about core and supercore measures?

Determine 2: Instantaneous inflation (T=12, a=4) per Eeckhout (2023) for core CPI (blue), chained core CPI, seasonally adjusted by creator utilizing X-13 (tan), PCE deflator (pink), CPI supercore (teal). Implied CPI goal incorporates the 0.45 ppts CPI-PCE differential over the 1986-2024 interval. Supply: BLS, BEA by way of FRED, BLS, and creator’s calculations.

Along with the optimistic data within the CPI measures, meals costs proceed to say no.

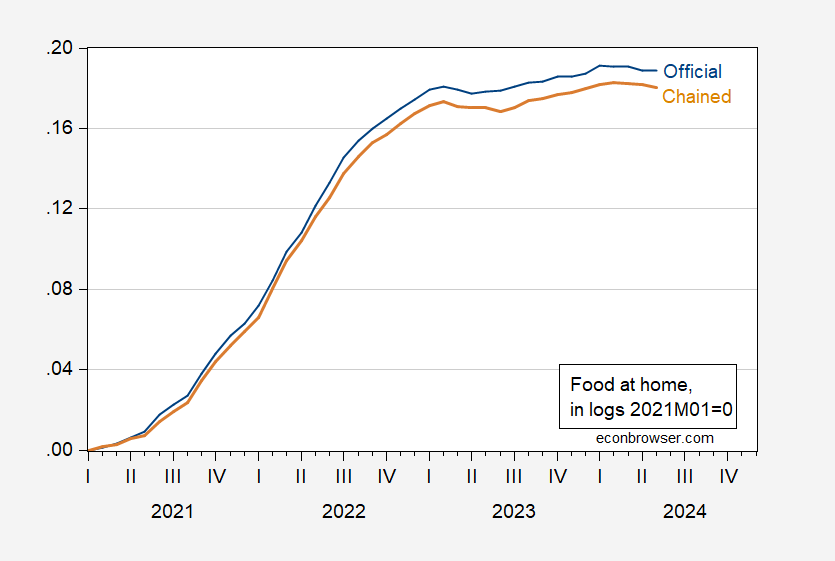

Determine 3: CPI part – meals at house (blue), and Chained CPI part – meals at house, seasonally adjusted by X-13 by creator (tan), each in logs 2021M01=0. Supply: BLS and creator’s calculations.

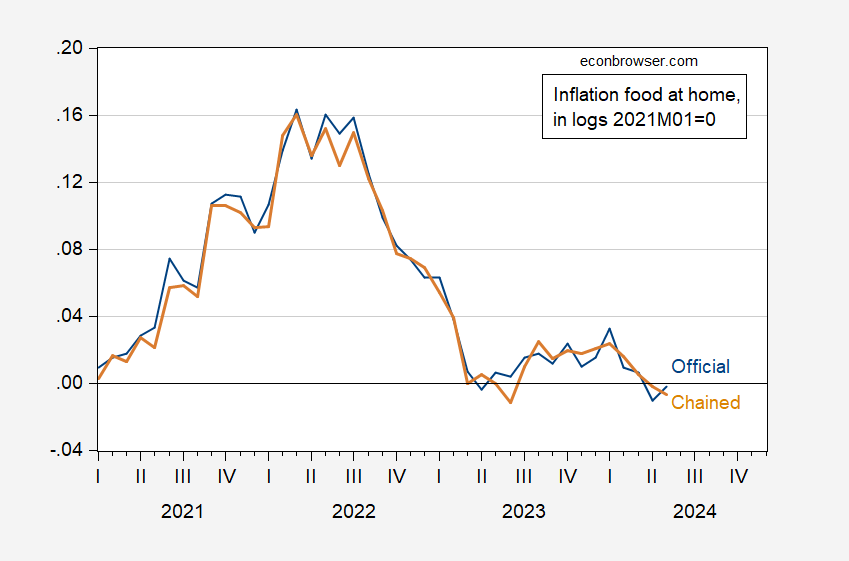

In different phrases, whereas official year-on-year meals at house inflation is 1.04%, instantaneous is -0.2% (q/q is -0.8% annualized), and chained (seasonally adjusted by creator) is -0.7%.

Determine 4: Instantaneous inflation fee (T=12, a=4) per Eeckhout (2023) for meals at house (blue), and chained, seasonally adjusted by X-13 by creator (tan). Supply: BLS and creator’s calculations.